Title: Market Sentiment US Stocks October 2025

author:US stockS -

Introduction: As we approach October 2025, investors are keenly focused on the market sentiment surrounding US stocks. With economic uncertainties and geopolitical tensions on the rise, understanding the current sentiment is crucial for making informed investment decisions. In this article, we delve into the key factors influencing market sentiment and provide insights into the potential trends for US stocks in October 2025.

Economic Factors One of the primary drivers of market sentiment is the economic landscape. In October 2025, several economic indicators will play a significant role in shaping investor perceptions. Key factors to consider include:

- GDP Growth: The pace of GDP growth will be closely monitored to gauge the overall health of the economy. A strong GDP growth rate is typically seen as a positive sign, indicating robust economic activity and potentially higher corporate earnings.

- Inflation: Inflation levels remain a major concern for investors. A moderate inflation rate is generally considered favorable, while high inflation can erode purchasing power and negatively impact stocks.

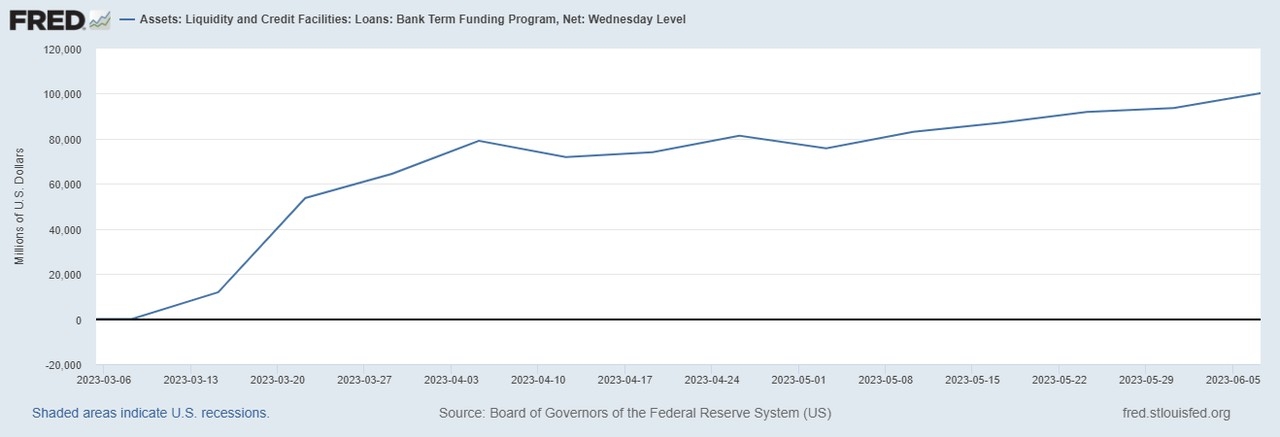

- Interest Rates: The Federal Reserve's monetary policy decisions will have a significant impact on market sentiment. Expectations of interest rate hikes or cuts will influence investor sentiment and potentially affect stock prices.

Geopolitical Tensions Geopolitical tensions continue to play a crucial role in market sentiment. In October 2025, investors will be closely monitoring developments in key regions, including:

- Trade Wars: The ongoing trade disputes between the US and other major economies, such as China, could escalate, affecting global supply chains and corporate earnings.

- Political Stability: The stability of political regimes in key countries, such as Russia and Iran, could impact global oil prices and, in turn, affect the energy sector and broader market sentiment.

- Cybersecurity Threats: Increasing cybersecurity threats could disrupt business operations and impact investor confidence.

Sector Analysis Understanding the sentiment within different sectors is essential for making informed investment decisions. In October 2025, the following sectors are likely to be of particular interest:

- Technology: The technology sector remains a significant driver of market sentiment. With advancements in AI, 5G, and cloud computing, investors are closely watching the performance of tech stocks.

- Healthcare: The healthcare sector is often seen as a defensive play during uncertain times. In October 2025, investors will be monitoring developments in biotechnology and pharmaceuticals.

- Energy: The energy sector is sensitive to geopolitical tensions and oil prices. In October 2025, investors will be analyzing the impact of global supply and demand dynamics on energy stocks.

Case Studies To illustrate the impact of market sentiment on US stocks, let's consider a few case studies:

- Apple Inc. (AAPL): In October 2025, investors are likely to be closely monitoring Apple's earnings reports and product launches. Positive sentiment surrounding the company's performance could drive stock prices higher.

- Tesla Inc. (TSLA): As the electric vehicle (EV) market continues to grow, investor sentiment towards Tesla will be influenced by factors such as production capacity, competition, and regulatory changes.

- Amazon.com Inc. (AMZN): The e-commerce giant's performance will be closely watched, with investors analyzing its growth prospects and the impact of rising competition.

Conclusion: In October 2025, market sentiment surrounding US stocks will be influenced by a combination of economic factors, geopolitical tensions, and sector-specific developments. By understanding these key factors and staying informed, investors can make more informed decisions and navigate the evolving market landscape.

new york stock exchange