Title: Impact of US CPI on Stock Market

author:US stockS -

Introduction: The Consumer Price Index (CPI) is a vital economic indicator that measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. In the United States, the CPI has a significant impact on the stock market, as it influences investors' expectations and the Federal Reserve's monetary policy decisions. This article delves into the impact of the US CPI on the stock market, highlighting its importance and providing insights into how it affects various sectors.

Understanding the CPI: The Consumer Price Index is calculated by the Bureau of Labor Statistics (BLS) and reflects the price changes of a basket of goods and services that are commonly purchased by consumers. The CPI is divided into several categories, including food and beverages, housing, transportation, medical care, education, and entertainment. The index is adjusted for seasonal variations and geographic differences.

Impact on Stock Market: The US CPI has a direct impact on the stock market through several channels:

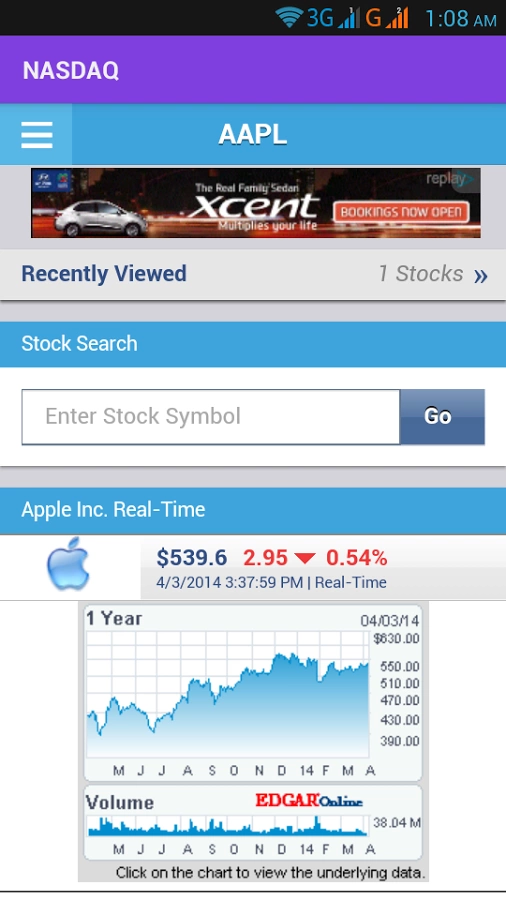

Inflation Expectations: The CPI is a key measure of inflation. When the CPI rises, it indicates higher inflation, which can lead to higher interest rates. Higher interest rates can negatively impact stocks, as they increase borrowing costs for companies and reduce the value of future earnings. Conversely, if the CPI falls, it suggests lower inflation, potentially leading to lower interest rates and a positive impact on stocks.

Earnings and Valuations: The CPI can influence corporate earnings and stock valuations. When the CPI rises, companies may face higher input costs, which can squeeze their profit margins. This can lead to lower earnings expectations and a decrease in stock prices. Conversely, if the CPI falls, companies may experience lower costs, leading to improved earnings and higher stock prices.

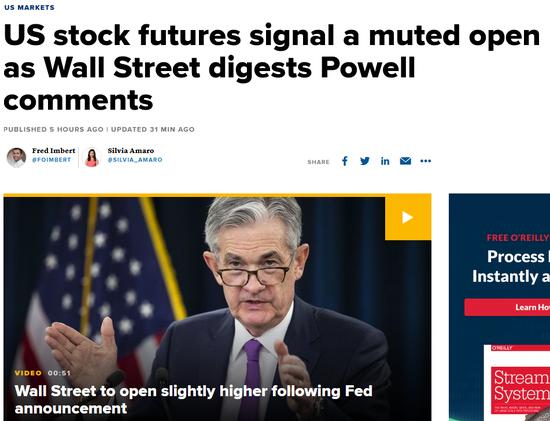

Monetary Policy: The Federal Reserve closely monitors the CPI to make decisions regarding monetary policy. If the CPI is rising above the Fed's target inflation rate, the Fed may raise interest rates to control inflation. Higher interest rates can negatively impact stocks, as discussed earlier. Conversely, if the CPI is below the target, the Fed may lower interest rates to stimulate economic growth, potentially benefiting stocks.

Sector-Specific Impacts: Different sectors of the stock market may be affected differently by the CPI. For example, companies in the consumer discretionary sector may be more sensitive to changes in consumer spending, which is influenced by the CPI. Similarly, companies in the energy and materials sectors may be more affected by changes in commodity prices, which can be influenced by inflation.

Case Studies: To illustrate the impact of the CPI on the stock market, let's consider a few case studies:

2008 Financial Crisis: During the financial crisis, the CPI rose significantly, leading to higher inflation expectations. This, combined with the Fed's aggressive monetary policy, resulted in a decline in stock prices. However, as the CPI started to fall and inflation expectations decreased, the stock market recovered.

2020 COVID-19 Pandemic: The COVID-19 pandemic led to a sharp decline in the CPI, as consumer spending decreased. This, along with the Fed's accommodative monetary policy, helped the stock market recover quickly. However, as the economy started to reopen and consumer spending increased, the CPI began to rise, raising concerns about future inflation and potentially affecting stock prices.

Conclusion: The Consumer Price Index (CPI) plays a crucial role in the stock market, influencing investors' expectations, corporate earnings, and monetary policy decisions. Understanding the impact of the CPI on the stock market can help investors make informed decisions and navigate market volatility. By monitoring the CPI and its implications, investors can better understand the potential risks and opportunities in the stock market.

new york stock exchange