Title: Best US Stocks for RRSP Investments

author:US stockS -

Introduction: Investing in the right stocks can be a game-changer for your RRSP (Registered Retirement Savings Plan). As a Canadian investor, finding the best US stocks for your RRSP can help maximize your returns and secure your financial future. In this article, we will explore some of the top US stocks that you should consider adding to your RRSP portfolio.

Apple Inc. (AAPL) As the world's largest technology company, Apple Inc. (AAPL) is a strong choice for RRSP investors. Its diverse product range, including iPhones, iPads, and Mac computers, ensures a steady revenue stream. With a strong presence in the tech industry, Apple has consistently delivered impressive growth and profitability. Case in point: Apple's revenue has increased by 92% over the past five years.

Microsoft Corporation (MSFT) Microsoft Corporation (MSFT) is another top pick for RRSP investors. As a leader in the software industry, Microsoft offers a wide range of products and services, including Windows, Office, and Azure cloud services. The company's solid financial performance and commitment to innovation make it a reliable investment. An example: Microsoft's revenue grew by 14% in the last fiscal year.

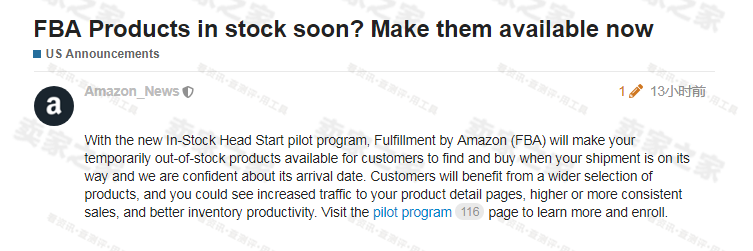

Amazon.com, Inc. (AMZN) Amazon.com, Inc. (AMZN) has revolutionized the retail industry and is a must-have for RRSP investors. With its vast product range and innovative business model, Amazon has become a dominant force in e-commerce. The company's continuous expansion into new markets and its focus on technology-driven solutions ensure long-term growth. Consider: Amazon's revenue increased by 27% in the last quarter.

Tesla, Inc. (TSLA) Tesla, Inc. (TSLA) is a leading player in the electric vehicle (EV) market and is a great addition to your RRSP portfolio. As the world shifts towards sustainable energy, Tesla's innovative products and strong brand position it for significant growth. An example: Tesla's revenue increased by 52% in the last quarter.

Facebook, Inc. (FB) Facebook, Inc. (FB), now known as Meta Platforms, Inc., is a social media giant and a solid investment for RRSP investors. The company's vast user base and strong advertising revenue make it a reliable source of income. Consider: Meta's revenue increased by 33% in the last fiscal year.

Johnson & Johnson (JNJ)

Johnson & Johnson (JNJ) is a leading healthcare company and a great long-term investment for RRSP investors. The company's diverse product portfolio, including pharmaceuticals, medical devices, and consumer healthcare products, ensures stability and growth. An example: JNJ's revenue increased by 7% in the last fiscal year.

Conclusion: Adding the right US stocks to your RRSP can significantly boost your investment returns. By focusing on companies with strong fundamentals, innovative products, and a commitment to growth, you can create a well-diversified portfolio that will help secure your financial future. Remember to consult with a financial advisor before making any investment decisions.

new york stock exchange