The Impact of US-China Trade War on Tech Stocks

author:US stockS -

In the wake of escalating tensions between the United States and China, the tech industry has become a focal point of the ongoing trade war. This article delves into how the conflict has affected tech stocks, analyzing key trends and offering insights into potential long-term impacts.

Understanding the Trade War

The trade war between the U.S. and China has been a long-standing issue, with both nations imposing tariffs on each other's goods. The tech industry, in particular, has been a major target of these tariffs, with significant implications for the global tech landscape.

Impact on Tech Stocks

The impact of the trade war on tech stocks has been multifaceted. Here are some key points to consider:

1. Increased Costs for Tech Companies

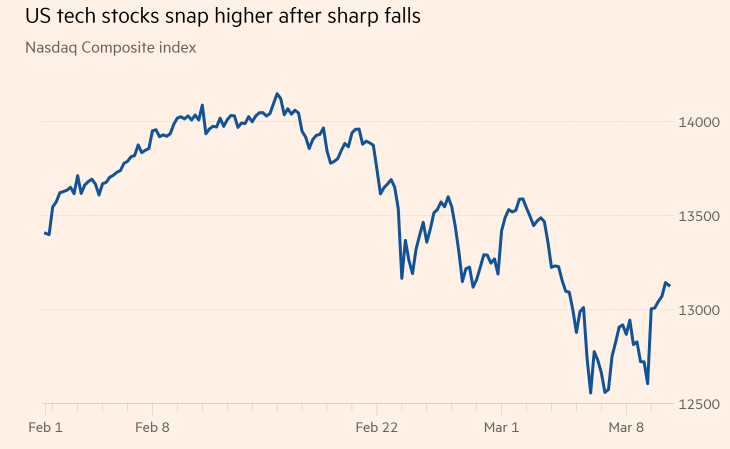

As the trade war continues, tech companies have been facing increased costs due to tariffs on components and finished goods. This has put pressure on their profit margins, leading to a decline in stock prices for many tech giants.

2. Supply Chain Disruptions

The trade war has also caused disruptions in global supply chains, with tech companies struggling to secure components from their usual suppliers. This has led to delays in product launches and increased costs, further affecting stock prices.

3. Investment Shifts

Investors have been cautious about tech stocks in light of the trade war, with many shifting their focus to companies with a stronger domestic presence. This shift in investment has also affected the performance of tech stocks.

Case Study: Apple

One of the most notable examples of the impact of the trade war on tech stocks is Apple Inc. The company, which relies heavily on Chinese manufacturing and sales, has been particularly affected by the conflict. As a result, Apple's stock price has experienced significant volatility, with investors expressing concerns about the company's future performance.

Long-term Implications

While the immediate impact of the trade war on tech stocks has been negative, the long-term implications are less clear. Here are some potential outcomes:

1. Increased Domestic Production

The trade war may lead to a shift in manufacturing to domestic markets, with tech companies looking to reduce their dependence on Chinese suppliers. This could result in a more balanced global supply chain and potentially lower costs for tech companies.

2. Technological Self-sufficiency

The trade war may also accelerate the push for technological self-sufficiency, with companies investing in research and development to reduce their reliance on foreign technology. This could lead to innovations and advancements in various tech sectors.

3. Strengthened Trade Relations

While the trade war has been a source of contention, it may also lead to a reevaluation of trade policies and the strengthening of relations between the U.S. and China. This could result in a resolution of the trade issues and a more stable global tech landscape.

In conclusion, the US-China trade war has had a significant impact on tech stocks, with companies facing increased costs, supply chain disruptions, and investment shifts. While the long-term implications remain uncertain, the conflict is likely to drive changes in the tech industry and global trade landscape.

new york stock exchange