Shorting US Stock Market: A Comprehensive Guide

author:US stockS -

In the volatile world of stock markets, shorting offers investors an alternative way to profit from a falling market. This guide delves into the basics of shorting the US stock market, its potential benefits, risks, and strategies to consider.

Understanding Shorting

What is Shorting? Shorting, also known as "selling short," is a trading strategy where investors borrow shares of a stock from a broker, sell them at the current market price, and then buy them back at a lower price in the future. The difference between the selling and buying price is the profit for the investor.

Why Short the US Stock Market? Investors may choose to short the US stock market for various reasons, including:

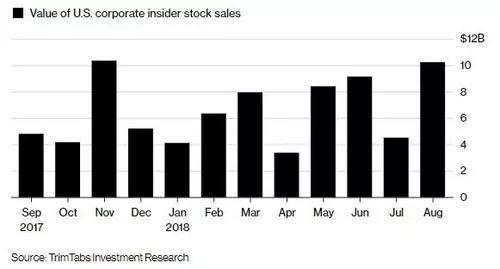

- Market Bearishness: When an investor believes that the overall market or a specific stock is overvalued and poised to decline.

- Speculation: Betting on a stock's decline due to company-specific issues, such as poor earnings reports or regulatory challenges.

- Hedging: Protecting a portfolio from potential losses in other investments.

Benefits of Shorting

- Profit from Falling Markets: Unlike traditional long positions, shorting allows investors to profit from falling stock prices.

- Diversification: Shorting can provide a hedge against market downturns, potentially reducing overall portfolio risk.

- Leverage: Shorting offers leverage, as investors can control a larger position with a smaller amount of capital.

Risks of Shorting

- Leverage Risks: Shorting can amplify losses, as investors are exposed to the full potential price volatility of the stock.

- Liquidity Issues: Shorting can be challenging in highly volatile or thinly traded stocks, making it difficult to exit the position at a desired price.

- Regulatory Risks: Shorting is subject to regulatory scrutiny, particularly in the context of "naked short selling," which involves selling shares that have not been borrowed.

Strategies for Shorting the US Stock Market

- Research and Analysis: Thoroughly research and analyze potential short candidates, considering factors like valuation, fundamentals, and technical indicators.

- Leverage Wisely: Use leverage judiciously, as excessive leverage can lead to significant losses.

- Stop Loss Orders: Implement stop loss orders to limit potential losses.

- Monitor Positions: Regularly monitor short positions to stay informed about market developments and adjust strategies as needed.

Case Studies

- Tesla (TSLA): In 2020, Tesla's stock experienced significant volatility, providing opportunities for short sellers. Investors who shorted TSLA and exited their positions at the right time could have realized substantial profits.

- Coca-Cola (KO): Despite being a well-established and stable company, Coca-Cola's stock has faced periods of downward pressure. Short sellers who identified these periods and executed their strategies effectively could have benefited from shorting KO.

Conclusion

Shorting the US stock market can be a powerful tool for investors looking to profit from falling markets. However, it's crucial to understand the risks and implement sound strategies to maximize potential gains. By conducting thorough research, managing leverage, and staying informed about market developments, investors can navigate the complexities of shorting and potentially achieve successful outcomes.

new york stock exchange