Oil Prices Extend Previous Gains on US Stocks Decline

author:US stockS -

In the wake of a significant downturn in the US stock market, oil prices have continued to extend their previous gains. This unexpected shift in the market dynamics has sparked a fresh wave of discussions and analyses among investors and market experts. This article delves into the reasons behind this trend and examines the potential implications for the global oil market.

The Underlying Factors

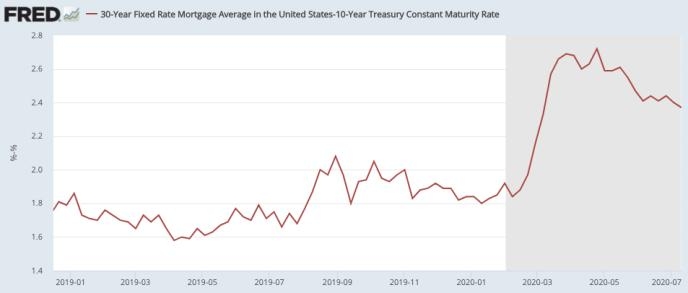

The decline in the US stock market can be attributed to several factors. The recent Federal Reserve's decision to raise interest rates and the increasing concerns over inflation have contributed to the market's instability. However, the oil market has managed to remain resilient, thanks to several underlying factors.

Supply Constraints and Geopolitical Tensions

One of the primary reasons for the sustained increase in oil prices is the supply constraints caused by geopolitical tensions. The conflict in Ukraine and the resulting sanctions have disrupted the supply of oil from major producers, leading to a shortage in the global market. This supply gap has been further compounded by the ongoing pandemic, which has reduced the demand for oil.

OPEC+ Production Cuts

The Organization of the Petroleum Exporting Countries (OPEC+) has also played a crucial role in driving up oil prices. In response to the global supply challenges, OPEC+ has agreed to reduce production levels. This decision has helped to support oil prices and ensure stability in the market.

US Stock Market Decline

The recent decline in the US stock market has further boosted oil prices. Investors seeking alternative investment options have turned to oil, which has historically been considered a safe haven asset. This shift in investment patterns has led to an increased demand for oil, pushing prices higher.

Case Studies

Several case studies highlight the correlation between the US stock market and oil prices. For instance, during the 2008 financial crisis, oil prices surged as the stock market plummeted. Similarly, in 2020, when the stock market tanked due to the COVID-19 pandemic, oil prices also experienced a significant uptick.

Potential Implications

The ongoing trend of oil prices extending their previous gains on the US stock market decline has several potential implications. Firstly, it suggests that oil remains a crucial component of the global energy mix and plays a vital role in the global economy. Secondly, it highlights the interconnectedness of various markets, with one market's movements having a significant impact on others.

Conclusion

In conclusion, the current trend of oil prices extending their previous gains on the US stock market decline is a result of a complex interplay of factors. While the decline in the stock market is a cause for concern, the resilience of the oil market provides a glimmer of hope. As investors continue to seek alternative investment options, the oil market is likely to remain a key player in the global financial landscape.

new york stock exchange