Nigeria Pulls from US Stocks: A Strategic Shift in Investment

author:US stockS -

In a significant move, Nigeria has recently started pulling its investments from the US stock market. This strategic shift has been a topic of intense debate among investors and financial analysts worldwide. The decision reflects Nigeria's growing economic diversification and a potential shift in its investment strategy. This article delves into the reasons behind this move, its implications, and the potential impact on the US stock market.

Reasons for the Shift

The primary reason for Nigeria's decision to pull from US stocks is the increasing cost of living and inflation in the country. Nigeria has been experiencing a rise in inflation rates, which has eroded the purchasing power of its citizens. As a result, the government is looking to invest in assets that can provide long-term stability and growth.

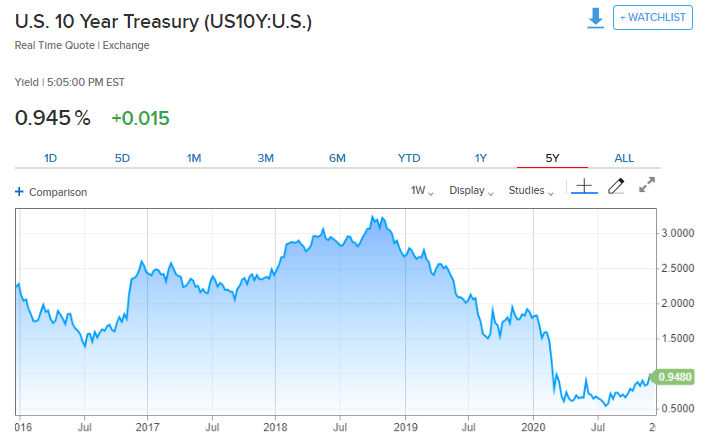

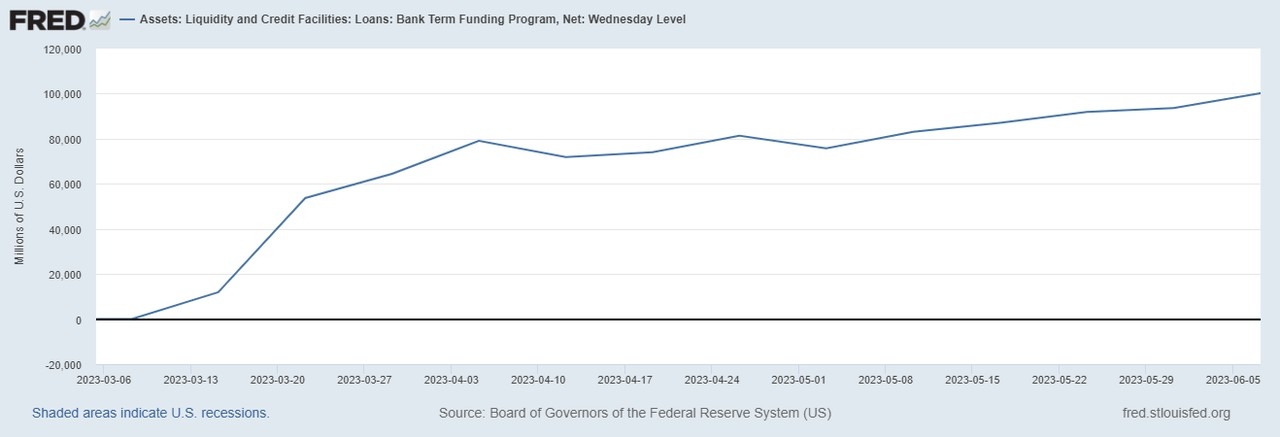

Additionally, the government has expressed concerns about the volatility of the US stock market. The recent market crashes and economic downturns have highlighted the risks associated with investing in US stocks. Nigeria's government, therefore, views diversifying its investment portfolio as a prudent decision to mitigate these risks.

Implications of the Shift

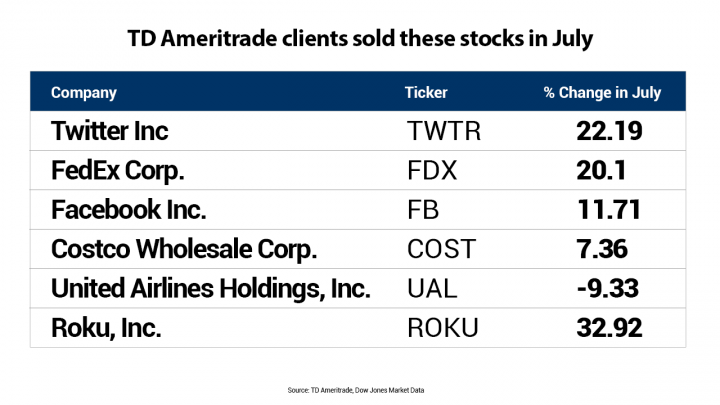

The shift from US stocks to alternative investment avenues has several implications. Firstly, it could lead to a decrease in demand for US stocks, potentially impacting their prices. This could be particularly noticeable in sectors that have a significant presence of Nigerian investors.

Secondly, the move indicates a growing trend of economic diversification among emerging markets. Nigeria, being Africa's largest economy, is leading the way in this regard. This trend could encourage other African countries to follow suit, further impacting the US stock market.

Potential Impact on the US Stock Market

While the immediate impact of Nigeria's decision on the US stock market is uncertain, it is expected to have a ripple effect. The withdrawal of Nigerian investments could lead to a slight decrease in demand for US stocks, which could, in turn, lead to a slight drop in their prices. However, the US stock market is large and diversified, and it is unlikely to be significantly impacted by Nigeria's decision alone.

Case Study: Nigeria's Investment in China

One notable case study is Nigeria's investment in China. In 2019, Nigeria's government invested $2 billion in China's Belt and Road Initiative. This investment has been beneficial for both countries, providing Nigeria with access to infrastructure development and China with a stable investment destination.

Conclusion

Nigeria's decision to pull from US stocks is a strategic move aimed at ensuring long-term economic stability and growth. While the immediate impact on the US stock market is uncertain, it is a clear indication of the growing trend of economic diversification among emerging markets. As the world's economies continue to evolve, such strategic shifts are likely to become more common.

new york stock exchange