Markets Selling Off: Understanding the Current Downturn

author:US stockS -

Introduction

The term "markets selling off" has become a common buzzword in the financial world, especially in recent months. It refers to a situation where the value of stocks, bonds, and other financial assets decline rapidly. This article delves into the reasons behind this downturn, its impact on investors, and the potential strategies to navigate through this challenging period.

What Causes Markets to Sell Off?

Several factors can lead to a market sell-off. One of the primary reasons is economic uncertainty. When investors are uncertain about the future of the economy, they tend to sell off their investments to mitigate potential losses. This uncertainty can arise from various sources, such as political instability, geopolitical tensions, or economic downturns.

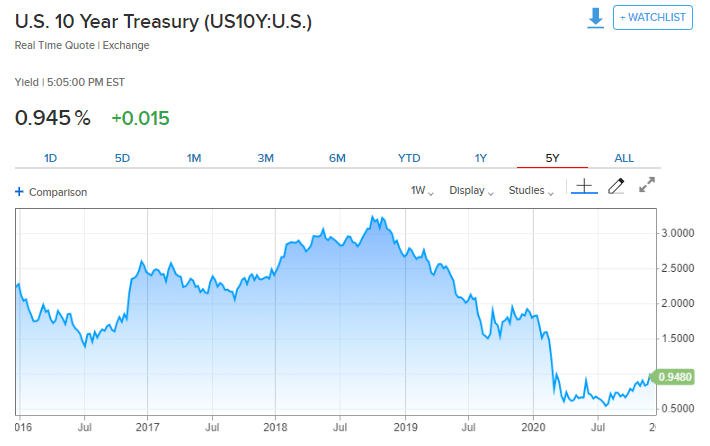

Another significant factor is interest rate hikes. Central banks, like the Federal Reserve, raise interest rates to control inflation. However, higher interest rates can lead to increased borrowing costs, which can negatively impact businesses and consumers. As a result, investors may sell off their investments in anticipation of a downturn.

Impact on Investors

A market sell-off can have a significant impact on investors. Those who are heavily invested in stocks may see their portfolios decline in value. This can be particularly devastating for investors who are nearing retirement or have a limited time horizon.

Moreover, a sell-off can create emotional stress among investors. The fear of losing money can lead to panic selling, which can exacerbate the downturn.

Navigating the Downturn

Despite the challenges, there are ways to navigate a market sell-off. Here are some strategies to consider:

- Diversify Your Portfolio: Diversification can help mitigate the impact of a market sell-off. By investing in a variety of assets, you can reduce your exposure to any single market or sector.

- Stay Calm and Invest for the Long Term: It's important to stay calm and invest for the long term. Markets tend to recover over time, and panic selling can lead to missed opportunities.

- Consider Adding Value Stocks: Value stocks are companies that are trading at a lower price relative to their fundamentals. These stocks can offer a good entry point during a market sell-off.

Case Study: The 2008 Financial Crisis

One of the most significant market sell-offs in recent history was the 2008 financial crisis. The crisis was triggered by the collapse of the housing market and the subsequent failure of several major financial institutions. The S&P 500 index fell by nearly 50% during the crisis.

However, those who stayed invested and diversified their portfolios were able to recover their losses over time. The S&P 500 index recovered to its pre-crisis level within a few years.

Conclusion

Markets selling off can be a daunting experience for investors. However, by understanding the causes and impact of a sell-off, and by adopting the right strategies, investors can navigate through this challenging period and emerge stronger.

new york stock exchange