Latest Analyst Upgrades: A Boost for US Stocks

author:US stockS -

In the ever-evolving world of finance, it's crucial to stay ahead of the curve. One of the latest trends that has caught investors' attention is the wave of analyst upgrades for US stocks. This surge in optimism has the potential to reshape the market landscape, offering investors new opportunities and challenges alike. Let's delve into the reasons behind these upgrades and what they mean for the future of US stocks.

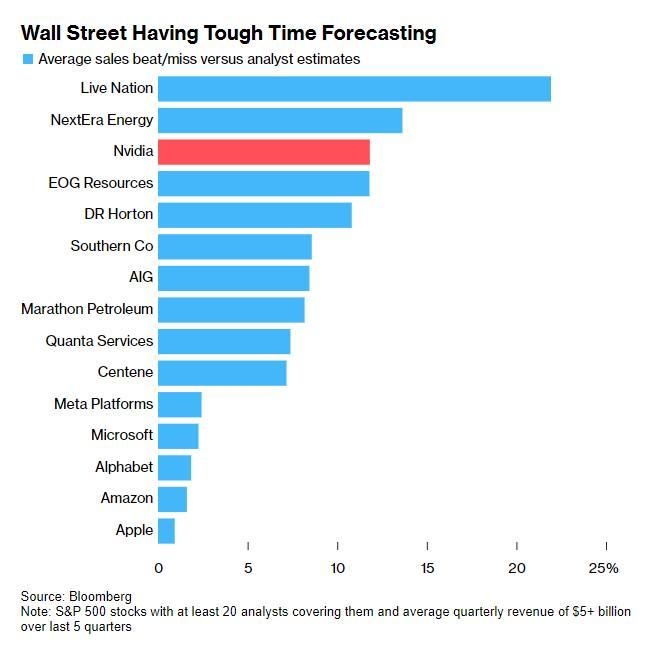

Rising Earnings Expectations

One of the primary reasons analysts are upgrading US stocks is the strong earnings growth expected in the coming quarters. Companies across various sectors, from technology to consumer goods, have reported robust revenue and profit numbers, fueling confidence among investors. As a result, analysts are revising their price targets upwards, anticipating further growth.

Technological Advancements and Innovation

The tech sector has been a significant driver of the US stock market's recent rally. Companies like Apple, Google, and Microsoft continue to innovate and dominate their respective markets, leading to strong growth prospects. Analysts are bullish on these tech giants, expecting them to maintain their market leadership and deliver impressive returns to investors.

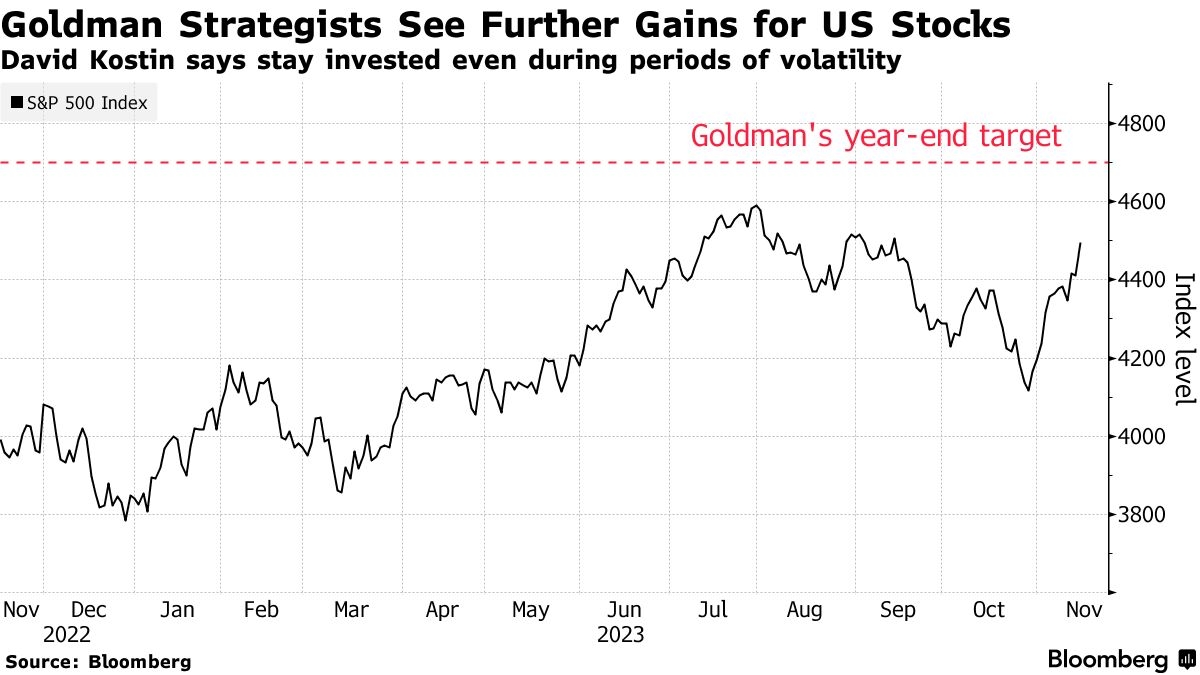

Economic Recovery and Low Interest Rates

The global economic recovery, particularly in the US, has been a key factor behind the analyst upgrades. With low interest rates and a supportive policy environment, businesses have been able to invest in expansion and innovation. This has created a positive outlook for the stock market, as investors anticipate companies to benefit from a strong economic backdrop.

Dividend Yield and Stability

Another reason for the analyst upgrades is the attractive dividend yields offered by many US stocks. With bond yields remaining low, investors are seeking higher yields from equities. Companies with strong financial health and stable cash flows are being rewarded with higher stock prices, as investors value their dividend payments.

Case Studies: Apple and Tesla

Let's take a closer look at two companies that have recently received analyst upgrades: Apple and Tesla.

Apple: Analysts have been bullish on Apple for several years, and the latest upgrades reflect their confidence in the company's long-term prospects. With its robust product lineup, including the iPhone, iPad, and Mac, Apple continues to dominate the tech industry. The company's strong earnings growth and attractive dividend yield have made it a favorite among investors.

Tesla: Tesla has been another recipient of analyst upgrades, driven by its leadership in the electric vehicle (EV) market. With its innovative products and ambitious expansion plans, Tesla is poised to continue its growth trajectory. Analysts are optimistic about the company's ability to capture a larger market share in the EV industry, leading to strong stock performance.

Conclusion

The latest analyst upgrades for US stocks are a sign of growing optimism in the market. With rising earnings expectations, technological advancements, economic recovery, and attractive dividend yields, investors have plenty of reasons to be upbeat. However, it's important to conduct thorough research and consider individual risk tolerance before making investment decisions. The stock market is always dynamic, and staying informed is key to navigating its complexities.

new york stock exchange