Is the US Stock Market Crashing Today?

author:US stockS -

Are you concerned about the current state of the US stock market? The recent volatility has left many investors wondering, "Is the US stock market crashing today?" In this article, we will delve into the latest developments and provide an analysis of the market's current situation.

Understanding Stock Market Volatility

To grasp the situation, it's crucial to understand the nature of stock market volatility. The stock market, by its very nature, is unpredictable and subject to various factors such as economic data, geopolitical events, and corporate earnings reports. Volatility refers to the degree of variation in a stock's price over a specific period, often measured by the standard deviation of daily returns. High volatility can lead to dramatic price swings, sometimes giving the impression of a market crash.

Recent Market Trends

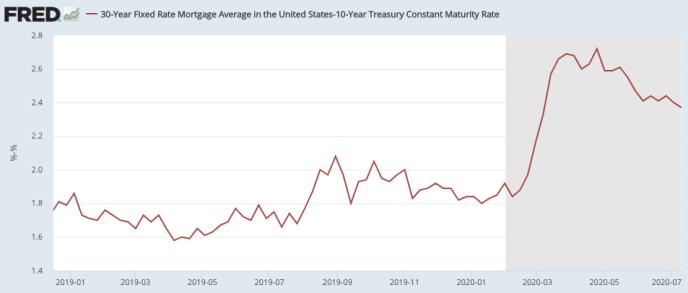

In recent weeks, the US stock market has experienced a significant amount of price fluctuations. Factors such as the Federal Reserve's interest rate decisions and COVID-19 pandemic developments have contributed to the volatility. Stock indexes like the S&P 500, the Dow Jones Industrial Average, and the NASDAQ have all seen substantial ups and downs.

Is the Market Crashing?

The question on everyone's mind is whether this volatility signifies a full-blown crash. While it's essential to remain cautious, the current situation may not be indicative of a complete market crash. Historical data shows that markets often experience corrections rather than crashes during periods of volatility.

Market Corrections vs. Crashes

A correction is defined as a decline of 10-20% in the stock market from its most recent peak. In contrast, a crash is characterized by a more significant and sudden decline, often exceeding 20-30%. While the market has seen some notable declines in recent weeks, it has yet to reach the levels typically associated with a crash.

Key Factors to Consider

Several factors can influence the market's direction, and investors should be aware of the following:

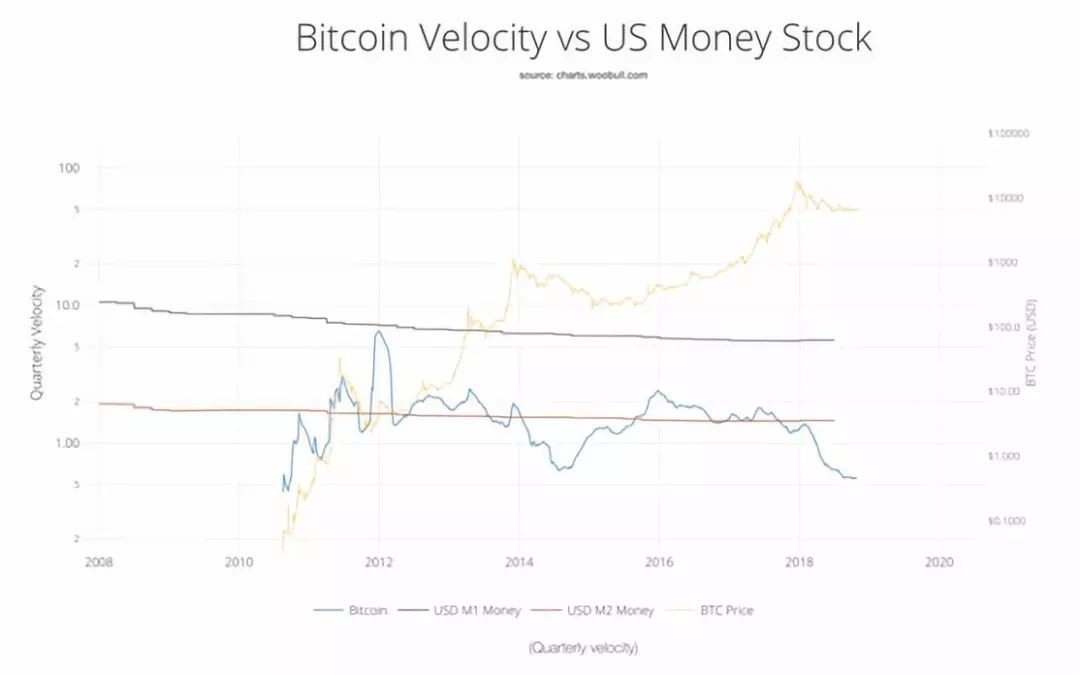

- Economic Data: Economic indicators such as unemployment rates, GDP growth, and inflation data can impact investor confidence and market performance.

- Corporate Earnings: Companies' earnings reports provide valuable insights into the health of the market and individual sectors.

- Geopolitical Events: Global events, such as trade tensions or political instability, can lead to increased market volatility.

- Technological Advances: Innovations in technology can drive market trends and influence the performance of specific sectors.

Case Studies

To illustrate the point, let's look at two historical events:

- The Dot-Com Bubble Burst (2000): This event resulted in a significant crash, with the NASDAQ losing over 80% of its value. The bubble was driven by speculative investment in technology stocks.

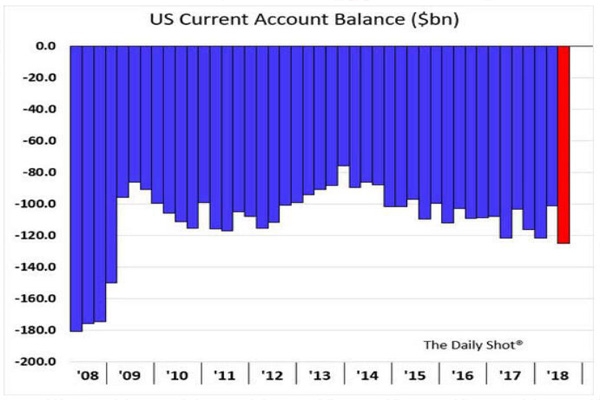

- The Global Financial Crisis (2008): The crisis was caused by the collapse of the housing market and resulted in a severe downturn, with the S&P 500 falling over 50%.

Conclusion

In conclusion, while the US stock market has experienced considerable volatility in recent weeks, it is essential to differentiate between a correction and a full-blown crash. Investors should remain cautious and consider the various factors that influence the market's direction. By staying informed and diversified, investors can navigate the current market environment and potentially mitigate losses.

new york stock exchange