Investing in US Stocks from the Philippines: A Comprehensive Guide

author:US stockS -

Are you considering buying US stocks from the Philippines? Investing abroad can be a daunting task, but with the right information and strategy, it can be a rewarding experience. This guide will help you navigate the process of purchasing US stocks from the Philippines, providing you with valuable insights and tips to make informed decisions.

Understanding the Basics

Before diving into the world of US stocks, it's crucial to understand the basics. US stocks represent ownership in a company based in the United States. By purchasing stocks, you become a shareholder and have a claim on the company's profits. Investing in US stocks from the Philippines offers several advantages, including:

- Diversification: Investing in stocks from different countries helps spread your risk.

- Access to a Larger Market: The US stock market is one of the largest and most diverse in the world, offering a wide range of investment opportunities.

- Potential for Higher Returns: Historically, the US stock market has provided higher returns compared to other markets.

How to Invest in US Stocks from the Philippines

Open a Brokerage Account: To buy US stocks from the Philippines, you need to open a brokerage account with a reputable online broker. Some popular options include TD Ameritrade, E*TRADE, and Fidelity. When choosing a broker, consider factors such as fees, customer service, and available investment options.

Research and Analyze Stocks: Once you have a brokerage account, it's time to research and analyze stocks. Look for companies with strong fundamentals, such as a solid financial track record, a strong management team, and a clear competitive advantage. Tools like fundamental analysis and technical analysis can help you make informed decisions.

Understand Risk and Reward: Investing in stocks always involves risk. Before investing, it's important to understand the potential risks and rewards. Risk tolerance is a key factor to consider, as it determines how much risk you're willing to take. Diversifying your portfolio can help mitigate risk.

Stay Informed: Keeping up with market news and trends is crucial for successful stock investing. Stay updated on economic indicators, company earnings reports, and geopolitical events that can impact stock prices.

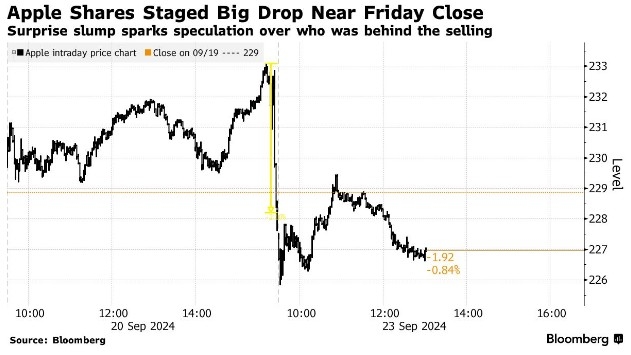

Case Study: Investing in Apple Inc. (AAPL)

As an example, let's consider investing in Apple Inc. (AAPL), one of the world's most valuable companies. Apple has a strong track record of innovation and has consistently delivered strong financial results. By purchasing Apple stock, you become a shareholder and have a claim on the company's profits.

When analyzing Apple, you may consider factors such as its revenue growth, profit margins, and market share. Additionally, it's important to stay informed about the latest product launches and technological advancements, as these can impact the company's stock price.

Conclusion

Buying US stocks from the Philippines can be a lucrative investment opportunity. By following this guide and conducting thorough research, you can make informed decisions and achieve your investment goals. Remember to stay disciplined, diversify your portfolio, and stay informed about market trends. Happy investing!

new york stock exchange