Investing in US Stocks from India: A Comprehensive Guide

author:US stockS -

Are you an Indian investor looking to diversify your portfolio by investing in US stocks? If so, you've come to the right place. Investing in US stocks from India can be a rewarding venture, offering numerous opportunities for growth and stability. In this comprehensive guide, we will explore the process of investing in US stocks from India, including the benefits, risks, and key considerations.

Understanding the US Stock Market

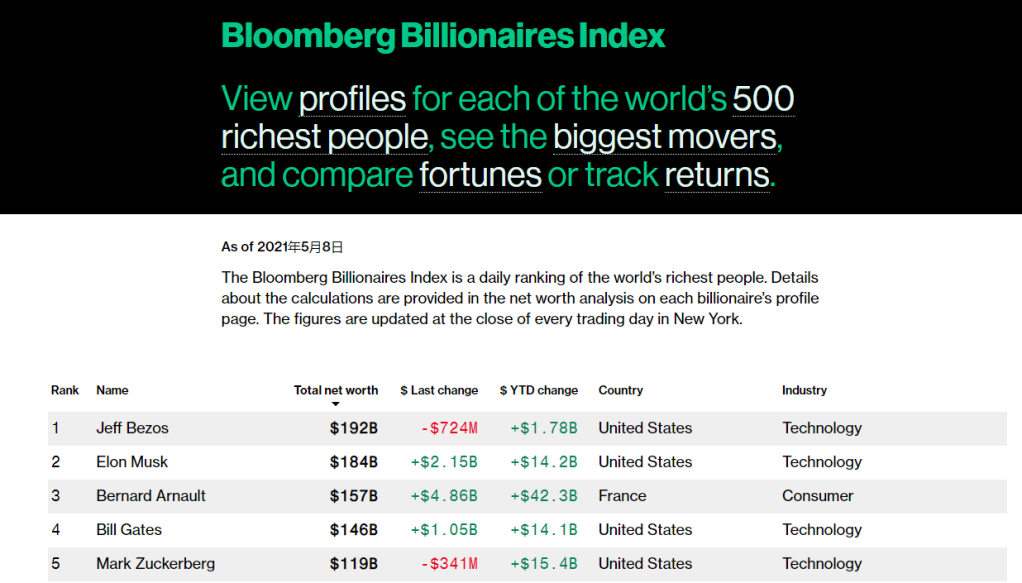

The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. The major stock exchanges in the US include the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list a diverse range of companies, from large-cap giants like Apple and Microsoft to small-cap startups with high growth potential.

Benefits of Investing in US Stocks from India

- Diversification: Investing in US stocks allows you to diversify your portfolio and reduce your exposure to the Indian market's volatility.

- Access to World-Class Companies: The US stock market offers access to some of the world's most successful and innovative companies.

- Potential for Higher Returns: Historically, the US stock market has provided higher returns compared to the Indian market.

- Currency Conversion: Investing in US stocks allows you to benefit from currency conversion, potentially leading to additional gains.

Risks to Consider

- Currency Fluctuations: Fluctuations in the USD-Indian Rupee exchange rate can impact your investment returns.

- Political and Economic Risks: The US stock market is influenced by various political and economic factors, which can impact your investments.

- Regulatory Risks: Different regulatory frameworks in the US and India can pose challenges for investors.

How to Invest in US Stocks from India

- Open a Brokerage Account: To invest in US stocks, you need to open a brokerage account with a reputable online broker. Some popular options for Indian investors include TD Ameritrade, E*TRADE, and Charles Schwab.

- Fund Transfer: Transfer funds from your Indian bank account to your brokerage account. Ensure that you have the necessary documentation and information ready for the transfer.

- Research and Analysis: Conduct thorough research and analysis of the companies you are interested in investing in. Consider factors like financial performance, market trends, and management quality.

- Place Your Order: Once you have selected a company, place your order through your brokerage account. You can choose to buy shares of the company or invest in exchange-traded funds (ETFs) that track the performance of the US stock market.

Case Study: Investing in Apple Inc.

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple Inc. (AAPL) after thorough research. The investor transfers

Conclusion

Investing in US stocks from India can be a lucrative opportunity for Indian investors. By understanding the process, conducting thorough research, and managing risks, you can diversify your portfolio and potentially achieve higher returns. Remember to choose a reputable broker, stay informed about market trends, and monitor your investments regularly.

new york stock exchange