How to Trade Stocks if I Am a US Resident

author:US stockS -

Embarking on the journey of stock trading can be an exciting venture for any US resident. However, it's essential to understand the basics and follow the right steps to make informed decisions. In this guide, we will explore the process of trading stocks, the platforms you can use, and some key strategies to help you get started.

Understanding the Basics of Stock Trading

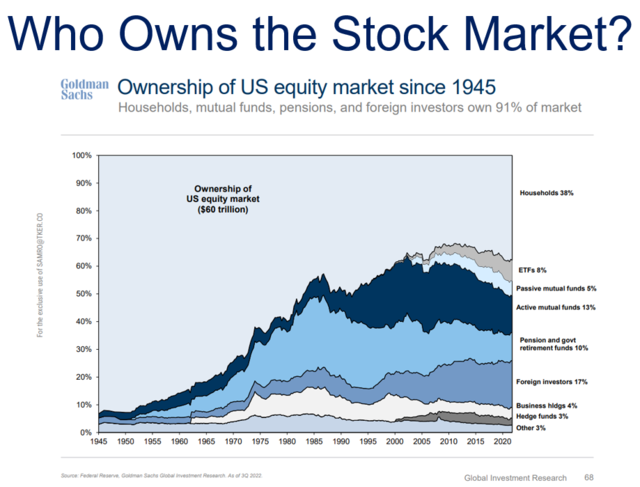

What is Stock Trading? Stock trading involves buying and selling shares of publicly traded companies. By purchasing stocks, you become a partial owner of the company, which can potentially provide returns through dividends and capital gains.

Why Trade Stocks? Investing in stocks can offer various benefits, including the potential for high returns, diversification, and the ability to grow your wealth over time. However, it's important to note that stock trading also comes with risks, and it's crucial to do your research and understand the market before getting started.

Choosing a Brokerage Account

Finding the Right Brokerage To start trading stocks, you need to open a brokerage account. A brokerage account is a secure account where you can buy and sell stocks. There are many brokerage firms available, each offering different services, fees, and features.

Considerations When Choosing a Brokerage When selecting a brokerage, consider factors such as fees, platform features, customer service, and available investment options. Some popular brokerage firms include Charles Schwab, Fidelity, and TD Ameritrade.

Understanding Brokerage Fees

Types of Brokerage Fees Brokers charge various fees for their services, including commission fees, account fees, and other transaction fees. It's important to understand these fees to avoid unexpected costs.

Comparing Brokerage Fees Compare the fees of different brokers to find the most cost-effective option for your trading needs. Keep in mind that lower fees don't always mean better service, so it's important to consider the overall value of the brokerage.

Getting Started with Stock Trading

Setting Up Your Account Once you've chosen a brokerage, you'll need to set up an account by providing personal information, verifying your identity, and funding your account.

Understanding Order Types When placing trades, you'll need to understand different order types, such as market orders, limit orders, and stop orders. Each order type has its own advantages and disadvantages, so it's important to choose the right one for your trading strategy.

Developing a Trading Strategy

Researching Stocks Before buying stocks, conduct thorough research to identify companies with strong fundamentals and potential for growth. Use tools like financial statements, news articles, and market analysis to inform your decisions.

Setting Realistic Goals Set realistic goals for your trading strategy, considering your risk tolerance and investment timeline. Avoid making impulsive decisions based on short-term market movements.

Implementing Risk Management Implement risk management techniques, such as diversifying your portfolio and setting stop-loss orders, to protect your investments from potential losses.

Case Study: Investing in Apple (AAPL)

Background Apple Inc. (AAPL) is a well-known technology company known for its innovative products and strong financial performance. As of 2021, AAPL is one of the most valuable companies in the world.

Investment Strategy Assuming you have done thorough research and identified AAPL as a potential investment, you can consider the following strategy:

- Buy Shares: Purchase shares of AAPL at a price you believe is undervalued.

- Diversify: Consider diversifying your portfolio by investing in other stocks or sectors.

- Monitor Performance: Regularly review the performance of your investment and adjust your strategy as needed.

By following these steps, you can begin trading stocks as a US resident and potentially grow your wealth over time. Remember to always do your research, stay disciplined, and be patient in your trading journey.

new york stock exchange