How to Buy US Stocks in Thailand: A Comprehensive Guide

author:US stockS -

Introduction:

Investing in the US stock market has always been a popular choice for international investors, and Thailand is no exception. With its growing economy and increasing number of investors, many Thais are looking to diversify their portfolios by investing in US stocks. However, the process can be overwhelming for those unfamiliar with the intricacies of the international market. In this comprehensive guide, we will walk you through the steps to buy US stocks in Thailand, ensuring a smooth and hassle-free investment experience.

- Understanding the Basics

Before diving into the investment process, it's essential to understand the basics of the US stock market. The stock market is a place where companies issue shares to the public, allowing individuals to buy and sell these shares. By owning shares, investors become partial owners of the company and are entitled to a portion of its profits, usually in the form of dividends.

- Choose a Reliable Broker

The first step in buying US stocks from Thailand is to choose a reliable brokerage firm. There are several brokerage firms that cater to international investors, offering various services and fees. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab. It's crucial to research and compare different brokerage firms to find one that meets your investment needs.

- Open a Brokerage Account

Once you have selected a brokerage firm, you will need to open a brokerage account. This process involves providing personal information, such as your name, address, and tax identification number. You may also need to undergo a verification process, which may include providing identification documents and proof of residence.

- Convert Thai Baht to US Dollars

To buy US stocks, you will need to convert Thai Baht to US Dollars. Several banks in Thailand offer currency exchange services, including Bangkok Bank, Siam Commercial Bank, and Krungthai Bank. It's important to compare exchange rates and fees before making your transaction to ensure you get the best deal.

- Transfer Funds to Your Brokerage Account

Once you have converted your Thai Baht to US Dollars, the next step is to transfer the funds to your brokerage account. Most brokerage firms offer various funding methods, including wire transfers, credit/debit cards, and bank drafts. Be sure to follow the instructions provided by your brokerage firm to ensure a smooth transfer.

- Research and Analyze US Stocks

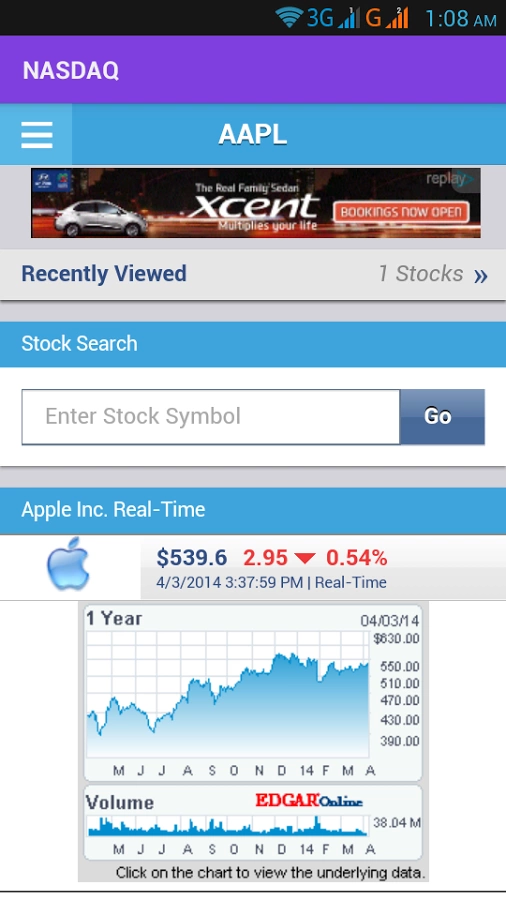

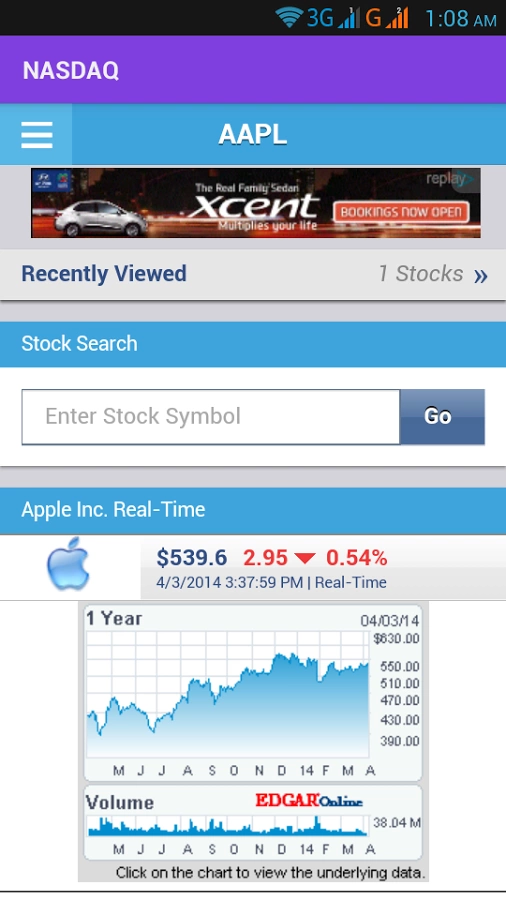

Now that you have funds in your brokerage account, it's time to research and analyze potential US stocks to invest in. This involves studying the financial health of the company, its industry position, and market trends. Utilize tools and resources provided by your brokerage firm, such as stock screeners and financial news, to identify promising investment opportunities.

- Place Your Order

Once you have identified a US stock you wish to purchase, you can place an order through your brokerage account. Most brokerage firms offer a user-friendly platform that allows you to place buy, sell, and limit orders. Be sure to double-check the order details before submitting it to avoid any errors.

- Monitor Your Investment

After purchasing US stocks, it's crucial to monitor your investment regularly. Keep track of the company's financial performance, market trends, and news that may affect its stock price. This will help you make informed decisions regarding buying, selling, or holding your investment.

Conclusion:

Investing in US stocks from Thailand can be a lucrative opportunity for international investors. By following the steps outlined in this guide, you can navigate the process and make informed investment decisions. Remember to do thorough research, choose a reliable brokerage firm, and monitor your investments to maximize your returns.

new york stock exchange