How to Buy Adidas Stock in the US

author:US stockS -

Are you looking to invest in Adidas, one of the world's leading sportswear brands? If so, you've come to the right place. This guide will walk you through the process of buying Adidas stock in the US, ensuring you can make an informed decision.

Understanding Adidas Stock

Before diving into the buying process, it's crucial to understand what Adidas stock represents. When you purchase Adidas stock, you're essentially buying a small piece of the company. As a shareholder, you'll have the right to vote on important corporate decisions and receive dividends, if the company decides to distribute them.

Finding a Broker

The first step in buying Adidas stock is to find a reliable brokerage firm. There are several reputable brokers in the US, each with its own set of fees, services, and tools. Some popular options include:

- Fidelity

- Charles Schwab

- E*TRADE

- Robinhood

Each broker offers a unique experience, so it's essential to research and choose the one that best suits your needs.

Opening an Account

Once you've selected a broker, the next step is to open an account. This process typically involves providing personal information, verifying your identity, and funding your account. Most brokers offer a user-friendly platform that makes it easy to open an account.

Researching Adidas

Before purchasing any stock, it's important to research the company. This includes understanding its financial health, growth potential, and industry position. Here are some key factors to consider when researching Adidas:

- Financial Statements: Review Adidas' annual and quarterly financial statements to understand its revenue, profit margins, and debt levels.

- Industry Trends: Stay informed about the sportswear industry and how it's evolving. This will help you assess Adidas' competitive position.

- Dividends: Determine if Adidas pays dividends and the current dividend yield.

Buying Adidas Stock

Once you've completed your research and are ready to buy, follow these steps:

- Log in to your brokerage account.

- Navigate to the "Stocks" or "Equities" section.

- Search for "Adidas" or use its ticker symbol, "ADS."

- Select the number of shares you want to buy and confirm the purchase.

Monitoring Your Investment

After purchasing Adidas stock, it's important to monitor your investment. This includes regularly reviewing the stock's performance, staying informed about company news, and adjusting your strategy as needed.

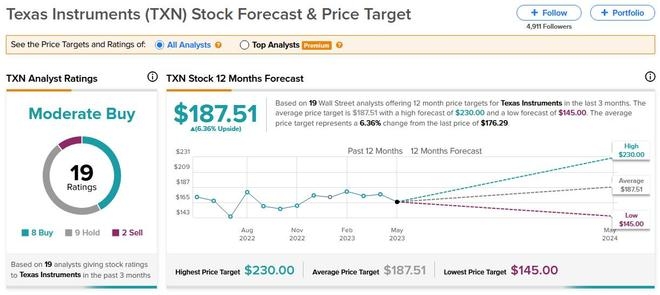

Case Study: Adidas Stock Performance

In 2020, Adidas faced significant challenges due to the global pandemic. However, the company managed to navigate these challenges and reported a strong performance in the second half of the year. As a result, Adidas stock experienced a significant uptick in value. This case study highlights the importance of staying informed and adapting to market conditions.

Conclusion

Buying Adidas stock in the US can be a rewarding investment opportunity. By following this guide, you can make an informed decision and potentially benefit from the company's growth and success. Remember to do your research, choose a reliable broker, and stay informed about the stock's performance. Happy investing!

new york stock exchange