Has the Stock Market Recovered? A Comprehensive Analysis

author:US stockS -

The recent volatility in the stock market has left many investors questioning whether the market has fully recovered from the previous downturn. In this article, we delve into the current state of the stock market, analyze key indicators, and provide insights into the recovery process.

Market Performance

To determine whether the stock market has recovered, it's crucial to look at various performance metrics. Over the past year, the S&P 500, a widely followed index of 500 large companies, has experienced significant growth. As of this writing, the S&P 500 has surged over 20% from its low point in March 2020, indicating a strong recovery.

Economic Indicators

Economic indicators play a vital role in assessing the health of the stock market. One of the most important indicators is unemployment rates. The unemployment rate has steadily decreased over the past year, reaching a pre-pandemic level. This decline suggests that the economy is on the path to recovery, which, in turn, bodes well for the stock market.

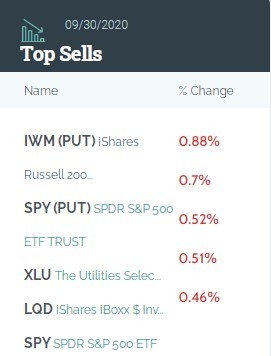

Sector Performance

Different sectors of the stock market have experienced varying degrees of recovery. Tech stocks, for instance, have been among the top performers, with companies like Apple and Microsoft posting substantial gains. On the other hand, sectors such as energy and financials have struggled to regain their pre-pandemic levels.

Dividend Yield

Dividend yield is another critical factor to consider when evaluating the stock market's recovery. The dividend yield represents the annual dividend payment as a percentage of the stock's current price. A higher dividend yield can indicate a stronger market. Currently, the dividend yield for the S&P 500 is around 2%, which is slightly higher than the historical average.

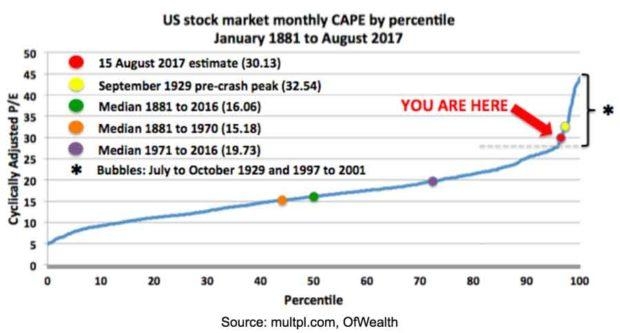

Market Valuations

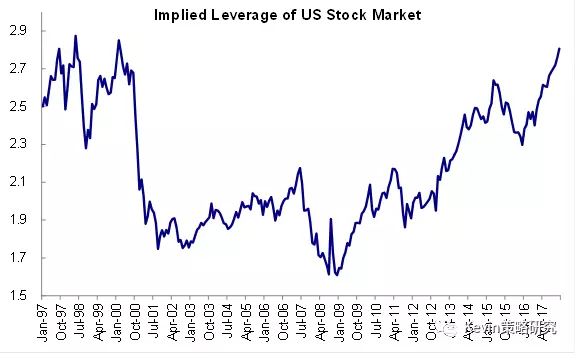

Market valuations also play a significant role in determining whether the stock market has recovered. One commonly used metric is the price-to-earnings (P/E) ratio. The P/E ratio measures the price of a stock relative to its earnings. A higher P/E ratio suggests that the market is overvalued, while a lower P/E ratio indicates undervaluation. As of this writing, the S&P 500's P/E ratio is around 22, which is slightly higher than the long-term average.

Case Studies

To further illustrate the stock market's recovery, let's take a look at some case studies. Apple, one of the largest companies in the world, has seen its stock price surge over the past year. The company's strong performance can be attributed to its robust product lineup and robust financials. Similarly, Microsoft has also experienced significant growth, driven by its cloud computing business and other revenue streams.

Conclusion

In conclusion, the stock market has shown signs of recovery over the past year. However, it's essential to monitor various indicators and economic factors to determine the full extent of the recovery. While the market has made substantial gains, it's still important to remain cautious and consider the potential risks. As always, consulting with a financial advisor is recommended before making any investment decisions.

new york stock exchange