Can Non-US Citizens Own US Stocks? A Comprehensive Guide

author:US stockS -

Are you a non-US citizen considering investing in the US stock market? If so, you've come to the right place. In this comprehensive guide, we'll explore whether or not non-US citizens can own US stocks, the process of purchasing them, and the benefits and risks associated with this investment opportunity.

Understanding the Basics

Firstly, it's important to clarify that non-US citizens can indeed own US stocks. However, there are certain regulations and procedures to follow, which we will delve into further below.

Regulations for Non-US Citizens Investing in US Stocks

The primary regulations to consider are those imposed by the U.S. Securities and Exchange Commission (SEC). These regulations aim to ensure that all investors, regardless of their citizenship, are protected and that the market remains fair and transparent.

One of the key regulations is the requirement for non-US citizens to declare their foreign status. This can be done through Form W-8BEN, which must be completed and submitted to the brokerage firm or financial institution handling the investment.

Additionally, non-US citizens are subject to U.S. tax laws when it comes to their investments. While capital gains tax may not apply directly to foreign investors, there are other tax considerations to keep in mind.

How to Purchase US Stocks as a Non-US Citizen

There are several methods for non-US citizens to purchase US stocks:

Through a Brokerage Firm: Many brokerage firms, such as Charles Schwab and Fidelity, offer services to international clients. These firms can assist with the necessary paperwork and facilitate the purchase of US stocks.

Through a Local Bank: Some banks offer investment services that allow non-US citizens to purchase US stocks. This can be a convenient option for those already conducting banking transactions with a specific institution.

Through a Mutual Fund: Investing in a mutual fund is another way to gain exposure to the US stock market without purchasing individual stocks. Many mutual funds cater to international investors.

Benefits of Investing in US Stocks as a Non-US Citizen

Diversification: Investing in US stocks can help diversify your investment portfolio, reducing your exposure to risks in your home country.

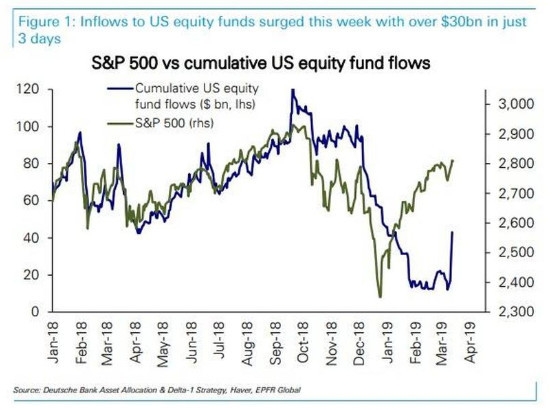

Potential for High Returns: The US stock market has historically offered significant returns, making it an attractive investment option for many.

Access to Innovative Companies: The US is home to some of the world's most innovative and successful companies. Investing in these companies can provide opportunities for substantial growth.

Risks to Consider

While investing in US stocks offers numerous benefits, there are also risks to consider:

Currency Fluctuations: Changes in exchange rates can impact the value of your investments when converted back to your home currency.

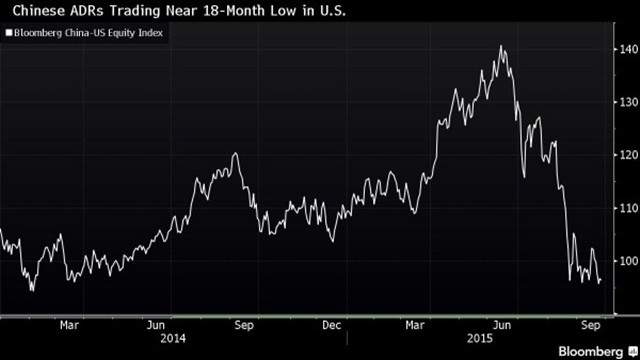

Political and Economic Factors: The US stock market is influenced by various political and economic factors, which can impact the performance of your investments.

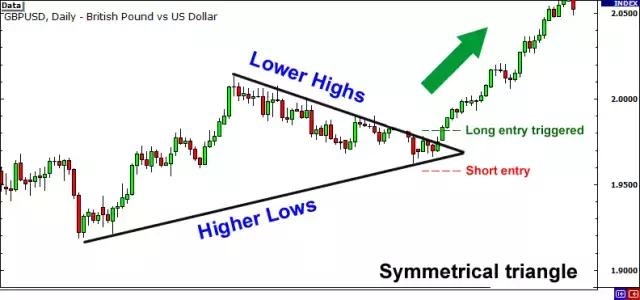

Market Volatility: The stock market can be volatile, and it's important to be prepared for potential fluctuations in the value of your investments.

Conclusion

In conclusion, non-US citizens can certainly own US stocks. However, it's crucial to understand the regulations, procedures, and potential risks associated with this investment opportunity. By doing so, you can make informed decisions and maximize your chances of success in the US stock market.

new york stock exchange