Buying US Stocks in Hong Kong: A Comprehensive Guide

author:US stockS -

Are you looking to diversify your investment portfolio by buying US stocks in Hong Kong? If so, you're in the right place. This guide will provide you with everything you need to know about investing in US stocks from Hong Kong, including the process, regulations, and potential benefits.

Understanding the Process

Investing in US stocks from Hong Kong involves several steps. First, you'll need to open a brokerage account with a reputable firm. This account will allow you to buy and sell stocks in the US. Once your account is set up, you can start researching and selecting stocks to invest in.

Choosing a Brokerage Firm

When choosing a brokerage firm, it's important to consider factors such as fees, customer service, and the range of investment options available. Some popular brokerage firms in Hong Kong that offer access to US stocks include Fidelity, Charles Schwab, and E*TRADE.

Understanding the Regulations

Investing in US stocks from Hong Kong is subject to certain regulations. For example, you'll need to comply with the Foreign Account Tax Compliance Act (FATCA) and report your investments to the Hong Kong tax authorities. It's important to understand these regulations to avoid any legal issues.

Benefits of Investing in US Stocks from Hong Kong

There are several benefits to investing in US stocks from Hong Kong:

- Diversification: Investing in US stocks can help diversify your portfolio and reduce risk.

- Access to a wide range of companies: The US stock market is home to some of the world's largest and most successful companies.

- Potential for higher returns: The US stock market has historically offered higher returns than many other markets.

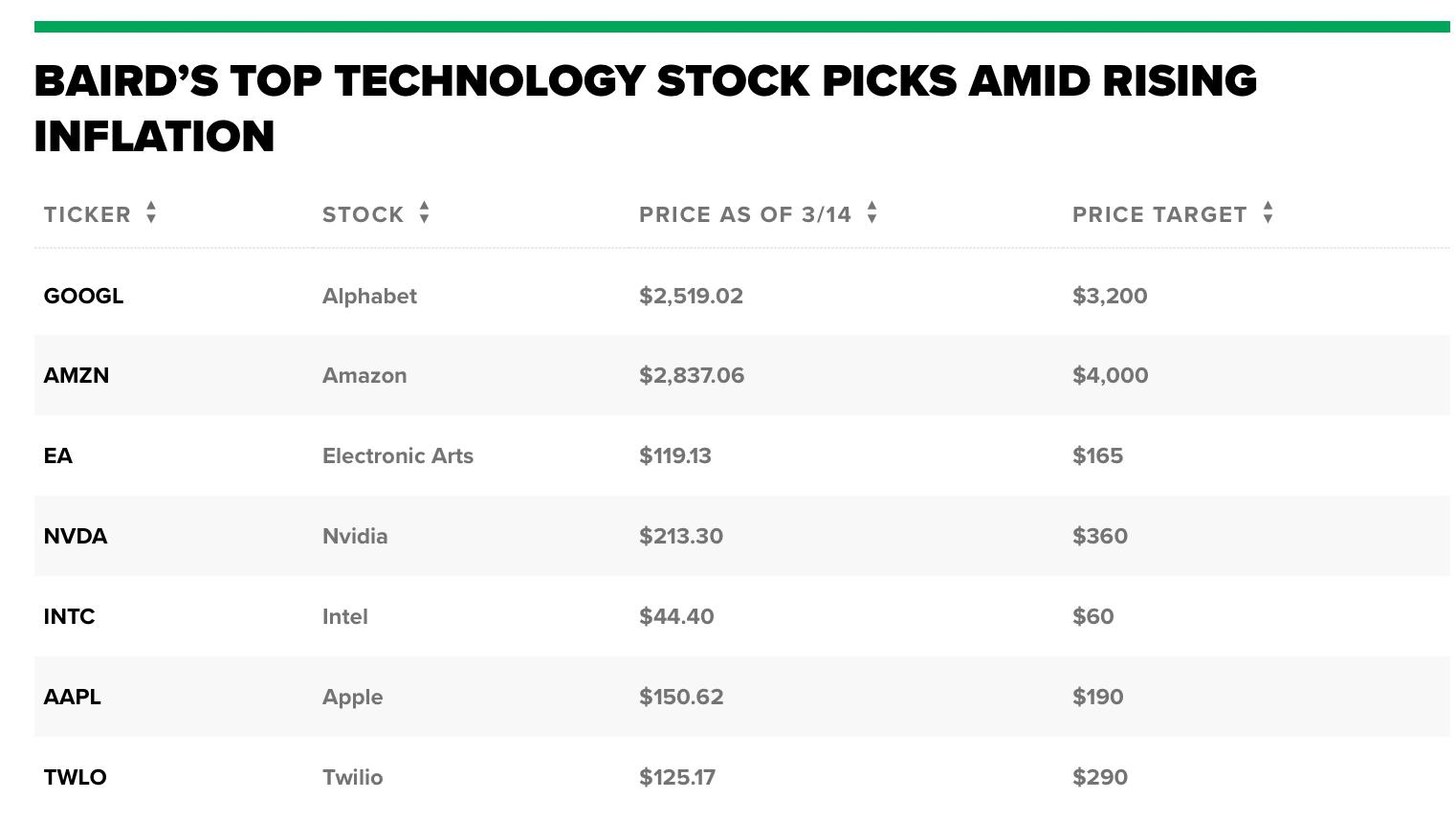

Researching and Selecting Stocks

Before investing in US stocks, it's important to research and select companies that align with your investment goals and risk tolerance. Some factors to consider include:

- Company fundamentals: Look for companies with strong financials, such as high revenue growth, low debt, and good profitability.

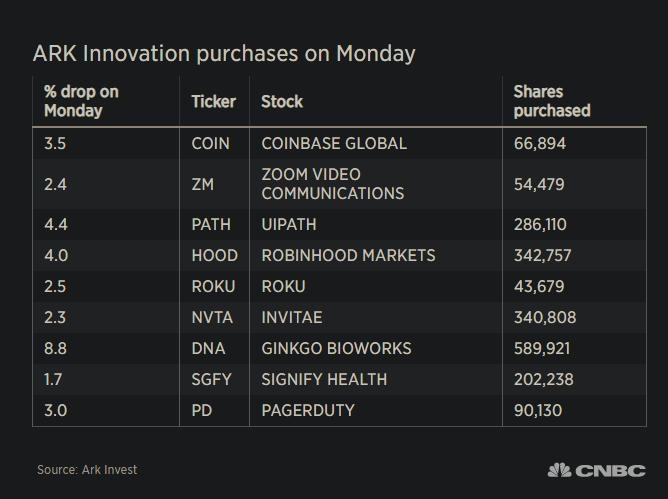

- Market trends: Stay informed about market trends and economic indicators that could impact the performance of US stocks.

- Dividends: Consider companies that offer dividends, as these can provide a steady stream of income.

Case Study: Investing in Apple Inc.

Let's say you're interested in investing in Apple Inc. (AAPL). After researching the company, you find that it has strong financials, a strong market position, and a history of dividend payments. You decide to purchase 100 shares of Apple at

Over the next year, Apple's stock price increases to

Conclusion

Investing in US stocks from Hong Kong can be a great way to diversify your investment portfolio and potentially earn higher returns. By following this guide and conducting thorough research, you can make informed investment decisions and achieve your financial goals.

Key Takeaways

- Open a brokerage account with a reputable firm.

- Understand the regulations.

- Research and select companies that align with your investment goals.

- Stay informed about market trends and economic indicators.

By following these steps, you can successfully invest in US stocks from Hong Kong and take advantage of the benefits of the US stock market.

new york stock exchange