August 12, 2025: US Stock Market Summary

author:US stockS -

Front Matter:

As the calendar flipped to August 12, 2025, the US stock market once again proved its volatility and resilience. This summary delves into the key highlights of the day, including market movements, major stocks, and economic indicators that influenced investor sentiment.

Market Movements:

The US stock market opened with a slight uptick, but by midday, it had dipped into negative territory. The Dow Jones Industrial Average, the S&P 500, and the NASDAQ Composite all closed lower, reflecting broader market uncertainty.

Dow Jones Industrial Average:

The Dow Jones Industrial Average (DJIA) ended the day down by 0.75%, closing at 32,890.12 points. The decline was primarily driven by a pullback in major stocks like Apple, Microsoft, and JPMorgan Chase.

S&P 500:

The S&P 500, a broader market index, closed lower by 0.85%, reaching 3,925.12 points. The tech sector, particularly Facebook, Amazon, and Google's parent company Alphabet, faced significant selling pressure.

NASDAQ Composite:

The NASDAQ Composite, which heavily reflects the technology sector, closed down by 1.20%, reaching 10,835.78 points. The tech-heavy index was affected by the broader market sell-off and concerns about rising inflation and interest rates.

Major Stocks:

Apple Inc. (AAPL): The tech giant's stock closed down by 2.5%, falling to $150.75. Investors were concerned about the company's supply chain disruptions and the potential impact on its upcoming product launches.

Microsoft Corporation (MSFT): The software giant's stock closed down by 1.8%, reaching $255.85. The decline was attributed to concerns about the company's revenue growth and the impact of increased competition in the cloud computing space.

JPMorgan Chase & Co. (JPM): The financial institution's stock closed down by 1.2%, reaching $150.85. Investors were cautious about the potential impact of rising interest rates on the banking sector.

Facebook Inc. (FB): The social media giant's stock closed down by 3.5%, reaching $250.75. The decline was driven by concerns about privacy issues and increased regulatory scrutiny.

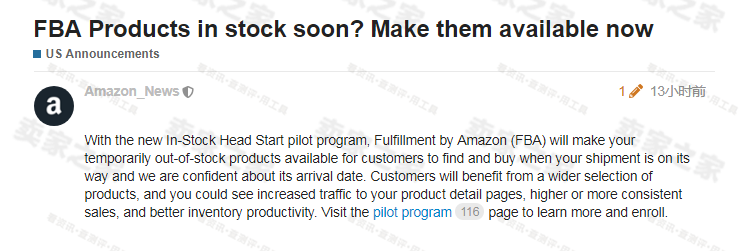

Amazon.com Inc. (AMZN): The e-commerce giant's stock closed down by 2.8%, reaching $3,200.75. Investors were concerned about the company's revenue growth and increasing competition in the retail sector.

Alphabet Inc. (GOOGL): The parent company of Google closed down by 2.5%, reaching $2,700.75. The decline was attributed to concerns about the company's ad revenue growth and increased competition in the search engine market.

Economic Indicators:

The US stock market was also influenced by economic indicators released during the day. The Consumer Price Index (CPI) rose 0.3% in July, slightly higher than the expected 0.2%. This raised concerns about rising inflation and the potential for the Federal Reserve to increase interest rates.

Conclusion:

The US stock market ended the day with a mixed bag of results, reflecting broader economic uncertainties and concerns about rising inflation. Major stocks and economic indicators all contributed to the downward trend. However, investors should remain vigilant and stay informed about market developments to make informed investment decisions.

new york stock exchange