In the vast and dynamic world of the U.S. stock market, active investment management stands as a beacon for investors seeking to outperform the market. This approach involves actively selecting and managing investments to capitalize on market opportunities and mitigate risks. This article delves into the various strategies employed by active investment managers in U.S. stocks and examines their track records of success.

Understanding Active Investment Management

Active investment management is distinct from passive management, which involves tracking a benchmark index. Active managers, on the other hand, actively search for undervalued securities and adjust their portfolios based on market conditions and their insights. This proactive approach requires a deep understanding of the market, extensive research, and the ability to make informed decisions.

Key Strategies in Active Investment Management

Stock Picking: This is the most common strategy, where managers identify undervalued stocks and hold them for the long term. They rely on fundamental analysis to assess a company's financial health, business model, and growth prospects.

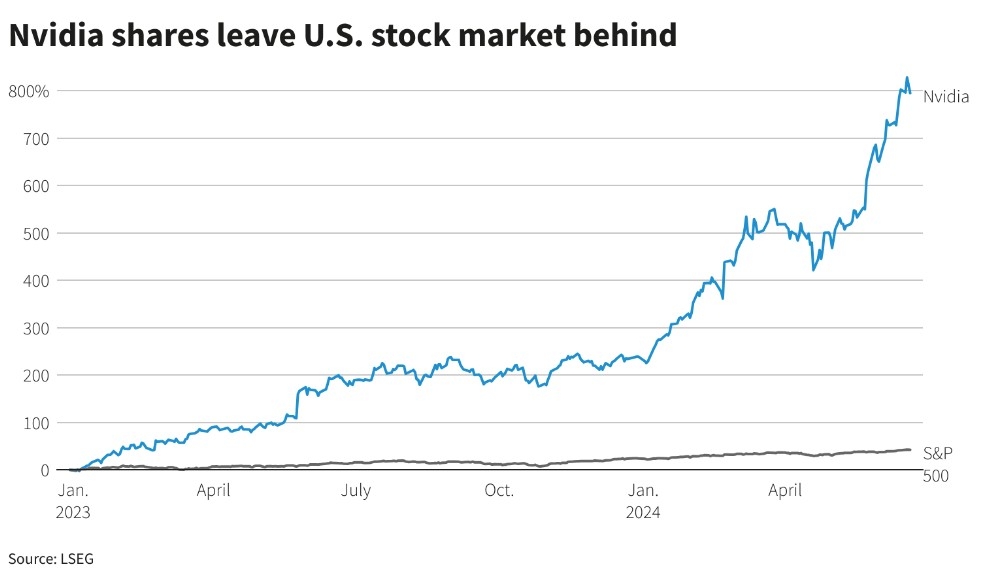

Sector Rotation: Active managers may shift their investments among different sectors based on their economic outlook. For example, they might invest heavily in technology stocks during a tech boom and move to defensive sectors like healthcare during a downturn.

Market Timing: This strategy involves predicting market trends and adjusting the portfolio accordingly. While challenging, successful market timing can lead to significant returns.

Momentum Investing: This approach involves investing in stocks that have shown strong price increases over a certain period. The idea is that these trends will continue.

Event-Driven Investing: Managers focus on companies with specific events that could impact their stock price, such as mergers, acquisitions, or earnings announcements.

Case Studies of Successful Active Management

George Soros: Known for his "black swan" theory, Soros predicted the 1992 British pound devaluation and made billions. His active management style, which involves extensive research and market analysis, has been a key factor in his success.

John Templeton: A renowned value investor, Templeton focused on finding undervalued stocks across the globe. His active management approach, which involved extensive research and a long-term perspective, led to significant returns.

Bill Ackman: Known for his value investing style, Ackman has successfully shorted stocks and invested in undervalued companies. His active management approach, which involves thorough research and a willingness to take contrarian positions, has led to significant success.

Conclusion

Active investment management in U.S. stocks requires a combination of skill, research, and market insight. While it comes with its own set of risks, the potential for outperformance makes it an attractive option for many investors. By understanding the various strategies and examining successful case studies, investors can make informed decisions and potentially achieve superior returns.

new york stock exchange