52 Weeks Low US Stocks: What You Need to Know

author:US stockS -

The stock market is a dynamic landscape, where prices fluctuate constantly. One critical metric investors watch closely is the 52-week low, which indicates the lowest price a stock has reached within the past year. Understanding this concept is crucial for investors looking to make informed decisions. In this article, we'll delve into what the 52-week low means, why it matters, and how it can impact your investment strategy.

What is the 52-Week Low?

The 52-week low is the lowest price a stock has traded at over the past 52 weeks. This period typically spans from one year to the next, making it a valuable indicator of a stock's performance. By comparing a stock's current price to its 52-week low, investors can gain insight into whether a stock is undervalued or overvalued.

Why Does the 52-Week Low Matter?

The 52-week low serves several important purposes:

- Valuation: It helps investors determine if a stock is trading at a low price relative to its historical performance. This can be particularly useful for value investors who look for stocks that are undervalued.

- Market Sentiment: The 52-week low can provide insights into market sentiment. If a stock has reached a new low, it may indicate that investors have negative sentiment towards the company or its industry.

- Risk Assessment: It can help investors assess the risk associated with a stock. A stock trading at a 52-week low may be more risky than one trading at a higher price, as it could be more vulnerable to further declines.

How to Use the 52-Week Low in Your Investment Strategy

Understanding the 52-week low can help you make more informed investment decisions. Here are a few ways to incorporate it into your strategy:

- Identify Undervalued Stocks: Look for stocks that have reached a new 52-week low and are trading significantly below their historical average. This could indicate an undervalued opportunity.

- Monitor Market Sentiment: Keep an eye on stocks that have hit a new 52-week low. If a stock continues to fall, it may be a sign of broader market concerns.

- Assess Risk: Be cautious when investing in stocks trading at a 52-week low, as they may be more vulnerable to further declines.

Case Studies

Let's look at a couple of recent examples:

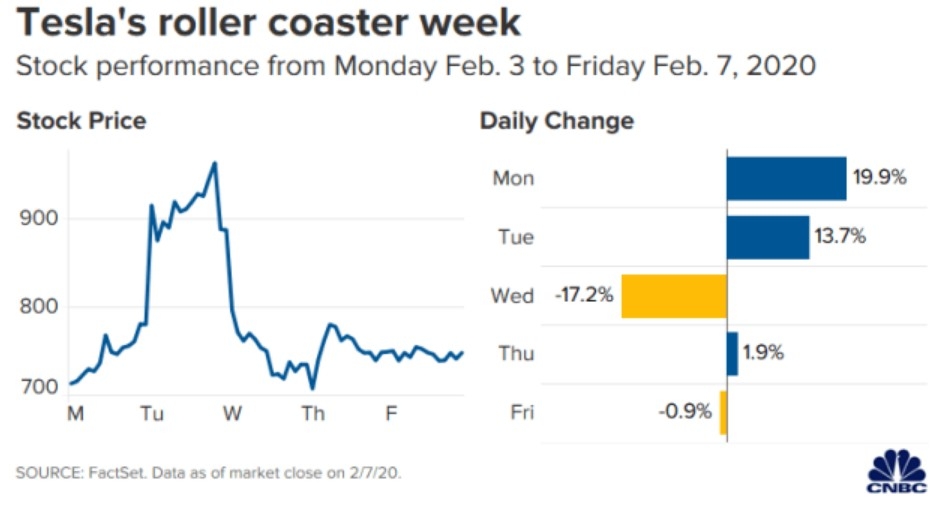

- Tesla (TSLA): In early 2020, Tesla's stock hit a 52-week low of around $30. Despite the low price, many investors saw it as a buying opportunity, and the stock has since soared to new highs.

- Facebook (FB): In late 2018, Facebook's stock hit a 52-week low of around $150. Investors who saw this as an undervalued opportunity ended up benefiting significantly as the stock recovered.

Conclusion

The 52-week low is a valuable metric for investors looking to gain insights into a stock's performance and potential. By understanding what it represents and how to use it, you can make more informed investment decisions. Remember to consider other factors, such as a company's fundamentals and market conditions, before making any investment decisions.

new york stock exchange