2025 US Stock Market Outlook Analysis

author:US stockS -

The stock market is a dynamic entity that reflects the economic pulse of a nation. As we delve into the 2025 US stock market outlook, it's crucial to understand the various factors that will shape its trajectory. This analysis will explore the key drivers, potential risks, and opportunities that investors should consider as they navigate the complexities of the market in the coming years.

Economic Factors

The economic landscape plays a pivotal role in shaping the stock market. Key factors to consider include:

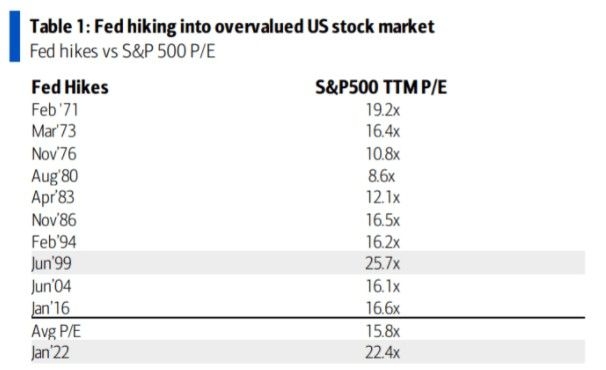

- Interest Rates: The Federal Reserve's monetary policy will significantly influence stock market movements. A hike in interest rates could lead to higher borrowing costs for companies, potentially affecting their profitability.

- Inflation: Inflationary pressures can erode purchasing power and impact corporate earnings. Investors will be closely monitoring inflation data to gauge the Fed's response.

- GDP Growth: A robust GDP growth rate indicates a strong economy, which is generally positive for the stock market. Conversely, a slowdown in GDP growth could lead to a bearish market.

Market Trends

Several trends are likely to influence the US stock market in 2025:

- Technology: The technology sector remains a significant driver of market growth. Companies like Apple, Microsoft, and Amazon continue to innovate and expand their market presence.

- Healthcare: The healthcare sector is poised for growth due to an aging population and increasing demand for medical services. Biotech and pharmaceutical companies are likely to benefit from this trend.

- Renewable Energy: The shift towards renewable energy sources presents opportunities for companies involved in solar, wind, and battery technology.

Potential Risks

Several risks could impact the US stock market in 2025:

- Political Uncertainty: Global political tensions and elections in key markets could create uncertainty and volatility.

- Trade Wars: Ongoing trade disputes could affect global supply chains and impact corporate earnings.

- Cybersecurity Threats: The increasing frequency and severity of cyberattacks pose a significant risk to businesses and their stock prices.

Investment Opportunities

Despite the potential risks, several investment opportunities are likely to emerge in the 2025 US stock market:

- Dividend Stocks: Companies with strong balance sheets and consistent dividend payments can provide a stable income stream for investors.

- Emerging Markets: Companies with a strong presence in emerging markets may benefit from growing economies and increasing consumer demand.

- Green Technology: As the world transitions to renewable energy sources, companies involved in green technology are likely to see significant growth.

Case Study: Tesla

Tesla, a leader in the electric vehicle (EV) market, exemplifies the potential of emerging sectors. As the world moves towards sustainability, Tesla's market value has surged. Its innovative technology and commitment to sustainability have made it a favorite among investors.

In conclusion, the 2025 US stock market outlook is shaped by a complex interplay of economic factors, market trends, and potential risks. Investors should stay informed and be prepared to adapt to changing conditions. By focusing on key sectors and considering potential risks, investors can position themselves for success in the dynamic US stock market.

new york stock exchange