Introduction: The stock market is a dynamic and complex landscape, where investors seek opportunities to grow their wealth. Among the myriad of stocks available, identifying the top 1000 stocks in the US can be a daunting task. In this article, we will delve into the characteristics of these top-performing stocks and provide insights into how investors can capitalize on this knowledge.

Understanding the Top 1000 Stocks in the US

The top 1000 stocks in the US are those that consistently outperform their peers in terms of market capitalization, profitability, and growth potential. These stocks are often found in various sectors, including technology, healthcare, finance, and consumer goods.

Key Factors Influencing the Top 1000 Stocks

Several factors contribute to the inclusion of a stock in the top 1000. These include:

- Market Capitalization: This measures the total value of a company's outstanding shares. Generally, stocks with higher market capitalization are more stable and have greater liquidity.

- Profitability: Companies with strong financial performance, including high revenue growth, profitability, and earnings per share, tend to be included in the top 1000.

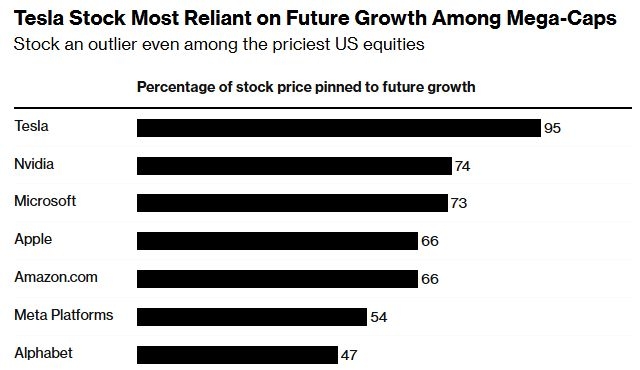

- Growth Potential: Companies that demonstrate potential for future growth, such as those with innovative products or services, are often considered for the top 1000 list.

- Dividend Yield: Companies that pay dividends to shareholders are often included in the top 1000, as they provide a steady income stream.

Sectors Represented in the Top 1000 Stocks

The top 1000 stocks in the US span across various sectors, with some of the most prominent ones being:

- Technology: This sector includes companies like Apple, Microsoft, and Amazon, which have become household names due to their innovation and market dominance.

- Healthcare: The healthcare sector encompasses pharmaceutical companies, biotech firms, and medical device manufacturers, such as Johnson & Johnson and Pfizer.

- Finance: Financial institutions, including banks, insurance companies, and investment firms, are well-represented in the top 1000, such as JPMorgan Chase and Wells Fargo.

- Consumer Goods: Companies like Procter & Gamble and Coca-Cola dominate this sector, offering a wide range of consumer products.

Case Studies: Successful Stocks in the Top 1000

To illustrate the success of stocks in the top 1000, let's consider a few case studies:

- Apple Inc.: Since its inclusion in the top 1000, Apple has grown exponentially, becoming the world's most valuable company. Its innovative products, such as the iPhone, have propelled its success.

- Johnson & Johnson: As a healthcare giant, Johnson & Johnson has consistently outperformed its peers, offering a diverse range of consumer healthcare products and pharmaceuticals.

- Walmart Inc.: This retail behemoth has become a staple in the top 1000, leveraging its vast network of stores and online presence to dominate the consumer goods market.

Conclusion: Investing in the top 1000 stocks in the US can be a wise decision for investors seeking long-term growth and stability. By understanding the factors that contribute to these stocks' success and identifying the sectors with the most potential, investors can make informed decisions to maximize their returns.

nasdaq futures now