When considering where to invest your hard-earned money, deciding between Canadian and U.S. stocks can be daunting. Both countries offer promising markets, but understanding the nuances can significantly impact your investment decisions. In this comprehensive guide, we will delve into the key factors to consider when choosing between Canadian and U.S. stocks.

1. Market Size and Growth Potential

U.S. Stocks:

The U.S. stock market is the largest in the world, boasting numerous leading companies across various sectors. This extensive market size provides a vast array of investment opportunities, making it an attractive choice for investors. Additionally, the U.S. economy has demonstrated robust growth over the years, fueling the success of many companies within its borders.

Canadian Stocks:

Canada, though smaller than the U.S., has a well-diversified stock market. It features a mix of natural resources, technology, and consumer goods companies. While the market size may not match that of the U.S., it still offers numerous potential investments and a promising growth outlook.

2. Currency Considerations

U.S. Stocks:

Investing in U.S. stocks means dealing with the U.S. dollar. If the Canadian dollar strengthens against the U.S. dollar, your investment gains will be more valuable in Canadian currency.

Canadian Stocks:

On the other hand, investing in Canadian stocks means dealing with the Canadian dollar. This currency's performance can influence your investment returns. However, Canadian stocks offer exposure to a stronger Canadian currency, which may provide additional protection against inflation.

3. Tax Implications

U.S. Stocks:

When investing in U.S. stocks, you will need to consider U.S. tax laws, which can be complex for Canadian investors. However, Canada has a tax treaty with the U.S. that may reduce the tax burden on Canadian investors.

Canadian Stocks:

Investing in Canadian stocks generally means dealing with Canadian tax laws. Canadian investors benefit from the ease of understanding and navigating the local tax system.

4. Market Volatility

U.S. Stocks:

The U.S. stock market is known for its volatility. This can be advantageous if you are a short-term investor looking for high returns. However, long-term investors may find this volatility challenging.

Canadian Stocks:

Canadian stocks tend to be less volatile compared to U.S. stocks. This stability can be appealing for long-term investors seeking consistent growth.

5. Diversification

U.S. Stocks:

Investing in U.S. stocks allows you to diversify your portfolio with a wide range of industries and companies.

Canadian Stocks:

Similarly, investing in Canadian stocks offers diversification opportunities across various sectors, although the market size may be smaller.

6. Case Studies

Consider the following case studies:

- Apple (AAPL): As one of the leading companies in the technology sector, Apple (AAPL) offers significant growth potential for U.S. investors. However, investing in Apple's stock may expose investors to the high volatility associated with the U.S. stock market.

- BHP Group (BHP): This leading global resources company, headquartered in Australia, is a prime example of investing in Canadian stocks, which can offer diversification and stability.

In conclusion, deciding between Canadian and U.S. stocks depends on various factors, including market size, growth potential, currency considerations, tax implications, market volatility, and diversification needs. As an investor, it's essential to weigh these factors carefully and align them with your investment goals and risk tolerance.

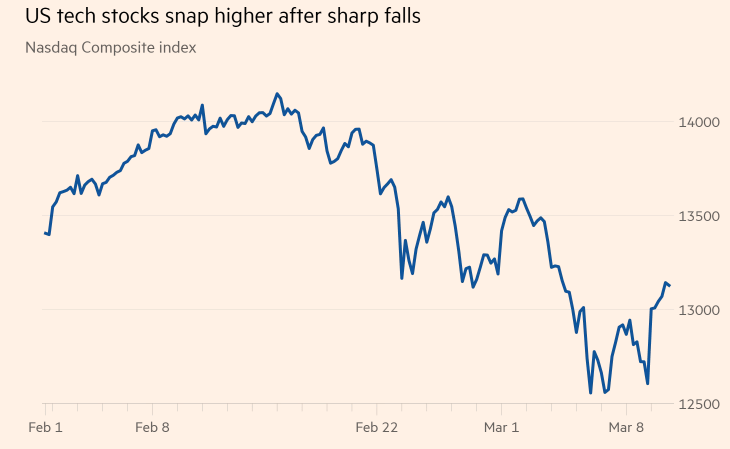

nasdaq futures now