Are you looking to invest in US stocks but worried about the fees? Moomoo, a popular online trading platform, offers a range of services, but understanding their fees is crucial for making informed decisions. In this article, we'll delve into the various Moomoo fees for US stocks, ensuring you have all the information you need to start trading confidently.

Understanding Moomoo Fees

Moomoo, also known as Moomoo Mobile, is a mobile trading app that provides users with access to a wide range of financial instruments, including stocks, bonds, futures, and options. One of the key aspects of using Moomoo is understanding the fees associated with trading US stocks.

Transaction Fees

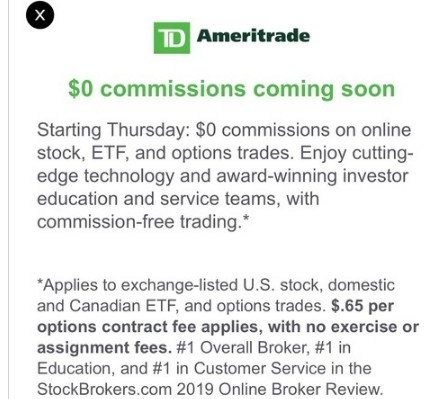

Moomoo offers commission-free trading for US stocks, which is a significant advantage over many other platforms. This means that you won't pay any fees for executing buy or sell orders for US stocks. However, it's important to note that this does not apply to all instruments on the platform.

Other Fees to Consider

While Moomoo offers commission-free trading for US stocks, there are other fees you should be aware of:

- Account Opening Fee: There is no account opening fee for Moomoo, making it an attractive option for new traders.

- Withdrawal Fees: Moomoo charges a fee for withdrawing funds from your account. The fee varies depending on the method of withdrawal.

- Currency Conversion Fees: If you're trading in a currency other than USD, you may incur currency conversion fees.

Understanding Moomoo's Fee Structure

To fully understand the fees associated with trading US stocks on Moomoo, it's important to consider the following:

- Order Types: Moomoo offers various order types, including market, limit, stop, and stop-limit orders. Each order type may have different fees or restrictions.

- Market Data: Moomoo provides real-time market data for US stocks, which is typically free. However, some users may opt for premium data services, which come with additional fees.

- Funding Fees: If you're using leverage to trade US stocks, you may incur funding fees. These fees are charged for borrowing funds from Moomoo to increase your trading power.

Case Study: Comparing Moomoo Fees with Other Platforms

Let's consider a hypothetical scenario to better understand how Moomoo's fees compare with other platforms:

- Platform A: Charges a $5 commission per trade for US stocks.

- Platform B: Offers commission-free trading for US stocks but charges a $10 monthly account fee.

In this scenario, if you were to trade 100 shares of a US stock, you would pay

Conclusion

Understanding the fees associated with trading US stocks on Moomoo is crucial for making informed decisions. While Moomoo offers commission-free trading for US stocks, there are other fees to consider, such as withdrawal fees and currency conversion fees. By carefully considering these fees and comparing them with other platforms, you can choose the best option for your trading needs.

nasdaq futures now