The stock market is often considered a barometer of the health of the economy. Its fluctuations can have a profound impact on various aspects of the US economy. Understanding this relationship is crucial for investors, businesses, and policymakers alike. This article delves into how the stock market affects the US economy, highlighting key areas of influence.

1. Consumer Confidence

Consumer confidence plays a pivotal role in the economy. When the stock market is performing well, individuals tend to feel wealthier and more optimistic about their financial future. This positive sentiment often translates into increased spending on goods and services, boosting economic growth. Conversely, a declining stock market can lead to decreased consumer confidence, resulting in reduced spending and slower economic growth.

2. Business Investment

The stock market also impacts business investment. When companies see their share prices rise, they may feel more financially secure and be more inclined to invest in new projects, expand operations, and hire additional employees. This can lead to increased economic activity and job creation. However, a falling stock market can discourage businesses from investing, potentially leading to a slowdown in economic growth.

3. Interest Rates

The stock market can influence interest rates, which, in turn, affect the economy. Central banks, such as the Federal Reserve, often monitor the stock market when setting interest rates. A volatile or declining stock market may prompt the Fed to lower interest rates to stimulate economic growth, while a stable and growing market may lead to higher rates to prevent inflation.

4. Employment

The stock market can also impact employment. As mentioned earlier, a rising stock market can encourage businesses to invest and hire more workers. Conversely, a falling market can lead to reduced hiring and, in some cases, layoffs. This is particularly true for industries heavily reliant on investor sentiment, such as technology and finance.

5. Government Revenue

The stock market can affect government revenue through capital gains taxes and corporate taxes. When the market is performing well, individuals and corporations may earn more capital gains, leading to increased tax revenue for the government. This can provide additional funding for public services and infrastructure projects. However, a declining market can result in reduced tax revenue, potentially leading to budget deficits and cuts in public spending.

Case Study: The 2008 Financial Crisis

One of the most significant examples of the stock market's impact on the US economy is the 2008 financial crisis. The collapse of the housing market and the subsequent stock market crash led to widespread economic turmoil. Many businesses went bankrupt, unemployment soared, and the government had to implement numerous stimulus measures to stabilize the economy.

In conclusion, the stock market has a multifaceted impact on the US economy. Its fluctuations can influence consumer confidence, business investment, interest rates, employment, and government revenue. Understanding this relationship is essential for anyone looking to navigate the complexities of the financial markets and the broader economy.

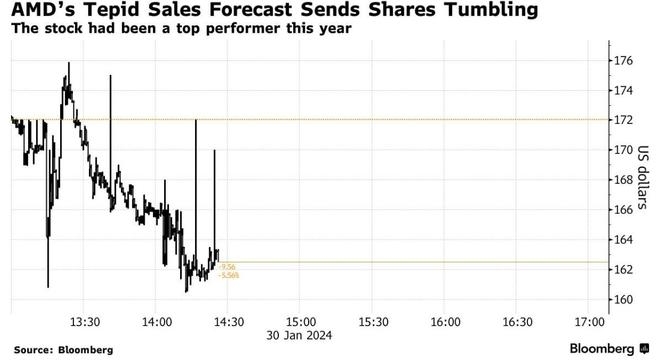

nasdaq futures now