Are you looking to invest in US stocks but unsure of the best mutual fund (MF) to choose? Look no further! In this comprehensive guide, we'll explore the top mutual funds for investing in US stocks, helping you make informed decisions for your portfolio.

Understanding Mutual Funds

Firstly, it's essential to understand what a mutual fund is. A mutual fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This diversification helps reduce risk and provides exposure to a broader market.

Why Invest in US Stocks?

Investing in US stocks offers several advantages. The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. Additionally, the US market has a strong history of growth and stability, making it an attractive option for investors.

Top Mutual Funds for US Stocks

Vanguard Total Stock Market Index Fund (VTSMX)

- Why It's Great: This fund offers exposure to the entire US stock market, providing a diversified portfolio. With a low expense ratio and a long track record of performance, it's a popular choice among investors.

- Performance: Over the past 10 years, the fund has returned an average of 9.5% annually.

Fidelity Spartan Total Market Index Fund (FSTMX)

- Why It's Great: Similar to the Vanguard fund, this fund provides exposure to the entire US stock market. It also offers a low expense ratio and has a strong track record of performance.

- Performance: Over the past 10 years, the fund has returned an average of 9.2% annually.

BlackRock iShares Core Total U.S. Stock ETF (IVV)

- Why It's Great: This ETF offers a cost-effective way to invest in the US stock market. It has a low expense ratio and provides exposure to a diversified portfolio of US stocks.

- Performance: Over the past 10 years, the fund has returned an average of 8.9% annually.

T. Rowe Price Global Stock Fund (PRGSX)

- Why It's Great: This fund invests in a diversified portfolio of international and US stocks. It offers exposure to emerging markets and has a strong track record of performance.

- Performance: Over the past 10 years, the fund has returned an average of 8.7% annually.

John Hancock U.S. Large Cap Equity Fund (JHCLX)

- Why It's Great: This fund focuses on large-cap US stocks. It has a low expense ratio and has a strong track record of performance.

- Performance: Over the past 10 years, the fund has returned an average of 9.8% annually.

Considerations When Choosing a Mutual Fund

When choosing a mutual fund for investing in US stocks, consider the following factors:

- Expense Ratio: A lower expense ratio means you'll pay less in fees.

- Diversification: Look for funds that provide exposure to a diverse range of stocks.

- Performance: Review the fund's historical performance, but remember past performance is not indicative of future results.

- Fund Manager: Consider the experience and track record of the fund manager.

Conclusion

Investing in US stocks through a mutual fund can be a great way to diversify your portfolio and potentially achieve long-term growth. By choosing the right mutual fund, you can maximize your returns and minimize risk. Remember to do your research and consult with a financial advisor before making any investment decisions.

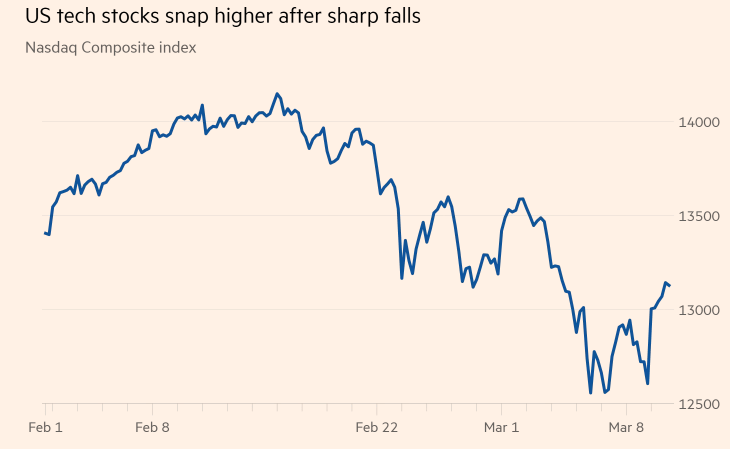

nasdaq futures now