Will Stocks Go Back Up? A Comprehensive Analysis

author:US stockS -

The stock market is often unpredictable, leaving many investors questioning whether stocks will ever return to their previous highs. In this article, we'll delve into various factors that could influence stock prices and provide insights into whether the market will bounce back.

Historical Performance

To understand the potential for stocks to go back up, it's crucial to examine historical performance. Historically, the stock market has experienced periods of ups and downs, but it has generally trended upwards over the long term. For instance, the S&P 500 index has returned an average annual gain of around 10% over the past century.

Economic Factors

Several economic factors can influence stock prices. One of the most significant is interest rates. When interest rates are low, borrowing costs are cheaper, which can stimulate economic growth and drive stock prices higher. Conversely, higher interest rates can lead to increased borrowing costs, which may dampen economic activity and negatively impact stocks.

Another important economic factor is inflation. When inflation is high, the purchasing power of money decreases, which can erode the value of stocks. However, moderate inflation can be a sign of a healthy economy, as it indicates growing demand for goods and services.

Market Sentiment

Market sentiment plays a significant role in stock prices. When investors are optimistic about the future, they tend to buy stocks, driving prices higher. Conversely, when investors are pessimistic, they may sell off their stocks, leading to a decline in prices.

Psychological factors, such as fear of missing out (FOMO) and herding behavior, can also impact market sentiment. During periods of volatility, investors may react emotionally, leading to rapid price movements.

Technological Advancements

Technological advancements can have a significant impact on stock prices. Innovations in industries such as artificial intelligence, biotechnology, and renewable energy can lead to the creation of new companies and the expansion of existing ones, driving stock prices higher.

Geopolitical Factors

Geopolitical events, such as political instability, trade disputes, and conflicts, can also impact stock prices. These events can lead to uncertainty in the market, causing investors to sell off their stocks and drive prices lower.

Case Studies

Let's take a look at a few historical examples to illustrate how stock prices have responded to various factors:

2008 Financial Crisis: The global financial crisis of 2008 led to a significant decline in stock prices. However, over the long term, the stock market recovered and reached new highs.

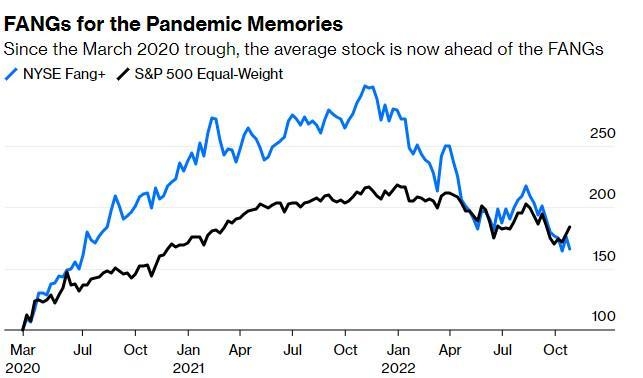

COVID-19 Pandemic: The COVID-19 pandemic caused a sharp drop in stock prices, but the market eventually recovered, driven by unprecedented stimulus measures and optimism about the economy's future.

Tech Stocks in 2021: Tech stocks experienced a massive rally in 2021, driven by advancements in technology and strong demand for digital services.

Conclusion

While it's impossible to predict the future with certainty, a combination of historical performance, economic factors, market sentiment, technological advancements, and geopolitical events suggests that stocks have a good chance of going back up. However, investors should always conduct thorough research and consider their risk tolerance before making investment decisions.

dow and nasdaq today