Unveiling the NASDAQ Index Share Price: Insights and Analysis"

author:US stockS -

Introduction: The NASDAQ index is one of the most renowned stock market indices in the world, representing the performance of technology and growth companies. Its share price is a crucial indicator of the market's sentiment and the health of the tech sector. In this article, we delve into the factors influencing the NASDAQ index share price, its historical performance, and provide valuable insights for investors.

Understanding the NASDAQ Index Share Price: The NASDAQ index consists of a selection of the largest and most influential companies in the technology sector, including giants like Apple, Microsoft, and Amazon. The index is calculated by dividing the total market capitalization of the constituent companies by the number of shares outstanding. The share price reflects the current market value of the index, which can fluctuate based on various factors.

Key Factors Influencing the NASDAQ Index Share Price:

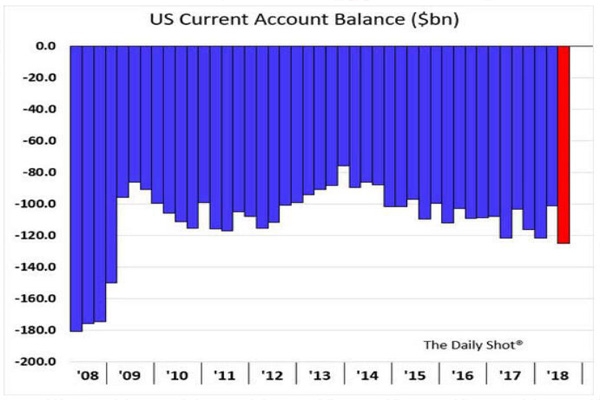

Economic Indicators: Economic reports, such as GDP growth, unemployment rates, and inflation, can significantly impact the NASDAQ index share price. Positive economic indicators often lead to increased investor confidence, driving up the index.

Company Performance: The performance of individual companies within the NASDAQ index can influence the overall index share price. Strong earnings reports or positive news from key companies can boost the index, while poor performance or negative news can lead to a decline.

Market Sentiment: Investor sentiment plays a crucial role in determining the NASDAQ index share price. Factors like political instability, global events, or changes in investor perceptions can cause significant volatility in the index.

Technological Advancements: As the NASDAQ index primarily consists of technology companies, advancements in technology can significantly impact the index. Innovations and breakthroughs in the tech sector can lead to increased investor interest and a rise in the index share price.

Interest Rates: Changes in interest rates can affect the NASDAQ index share price. Higher interest rates can make borrowing more expensive, impacting the profitability of companies in the index. Conversely, lower interest rates can stimulate economic growth and boost the index.

Historical Performance: The NASDAQ index has experienced significant growth over the years, particularly in the technology sector. In the 1990s, the index saw a remarkable surge, often referred to as the "dot-com bubble." However, the bubble burst in 2000, leading to a sharp decline in the index. Since then, the NASDAQ has recovered and continued to grow, reflecting the resilience of the technology sector.

Case Study: Facebook's Impact on the NASDAQ Index In 2012, Facebook became a publicly traded company and was added to the NASDAQ index. The addition of such a significant company had a substantial impact on the index. Following the company's IPO, the NASDAQ index experienced a brief surge, showcasing the influence of individual companies on the overall index.

Conclusion: The NASDAQ index share price is a critical indicator of the technology sector's performance and market sentiment. By understanding the key factors influencing the index, investors can make informed decisions. As technology continues to evolve, the NASDAQ index is expected to remain a significant benchmark for the industry.

dow and nasdaq today