Unlocking the Potential of U.S. Stocks: A Comprehensive Guide

author:US stockS -

Are you intrigued by the world of U.S. stocks? Do you want to understand how to navigate this dynamic market and potentially earn substantial returns? Look no further! This article will serve as your comprehensive guide to investing in U.S. stocks, offering valuable insights and strategies to help you make informed decisions.

Understanding U.S. Stocks

Firstly, let's clarify what U.S. stocks are. A stock represents a share in the ownership of a company. When you purchase a stock, you become a shareholder, entitled to a portion of the company's profits. U.S. stocks are among the most popular and liquid investments in the world, offering investors a wide range of opportunities.

Types of U.S. Stocks

There are various types of U.S. stocks to choose from, each with its own unique characteristics:

- Common Stocks: These are the most common type of stock, representing ownership in the company and the right to vote on corporate matters.

- Preferred Stocks: These stocks offer a higher claim on the company's assets and earnings compared to common stocks, but typically do not come with voting rights.

- Blue-Chip Stocks: These are shares of well-established and financially stable companies with a long history of profitability and reliable dividends.

- Growth Stocks: These stocks belong to companies with high growth potential, often reinvesting their earnings to fuel further expansion.

How to Invest in U.S. Stocks

Investing in U.S. stocks involves several steps:

- Research and Education: Educate yourself about the stock market, including fundamental and technical analysis, as well as market trends and economic indicators.

- Choose a Brokerage Account: Open a brokerage account to buy and sell stocks. There are numerous brokerage platforms available, each offering different features and fees.

- Select Stocks: Research and select stocks that align with your investment goals, risk tolerance, and time horizon.

- Diversify Your Portfolio: Diversify your investments across different sectors, industries, and asset classes to mitigate risk.

- Monitor Your Investments: Regularly review your portfolio to ensure it remains aligned with your investment objectives.

Key Considerations for U.S. Stock Investors

Here are some important factors to consider when investing in U.S. stocks:

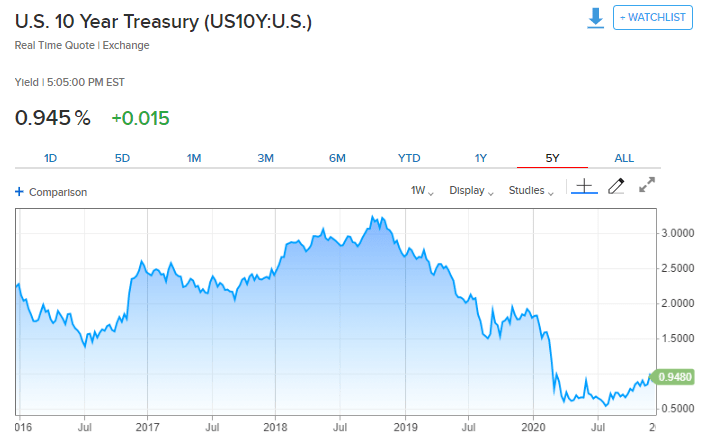

- Market Conditions: Be aware of the overall market conditions, including economic indicators, interest rates, and geopolitical events.

- Company Fundamentals: Analyze the financial health and performance of the companies you are considering investing in.

- Dividends: Consider the dividend yield of a stock, as it can provide a steady stream of income.

- Risk Management: Implement risk management strategies, such as stop-loss orders and diversification, to protect your investments.

Case Studies: Successful U.S. Stock Investments

Several notable investors have achieved success in the U.S. stock market. Here are a few examples:

- Warren Buffett: The "Oracle of Omaha" has built Berkshire Hathaway into one of the world's most successful companies through strategic investments in U.S. stocks.

- Peter Lynch: As the manager of the Fidelity Magellan Fund, Lynch achieved an annualized return of 29% from 1977 to 1990, investing primarily in U.S. stocks.

- Jensen Huang: The co-founder and CEO of NVIDIA has led the company to significant growth, with its stock returning over 1,000% in the past decade.

Conclusion

Investing in U.S. stocks can be a rewarding endeavor, but it requires thorough research, education, and discipline. By understanding the types of U.S. stocks, the investment process, and key considerations, you can make informed decisions and potentially achieve substantial returns. Remember to stay informed, diversify your investments, and manage risk effectively. Happy investing!

dow and nasdaq today