Unlock the Potential of US Mint Stocks: A Comprehensive Guide

author:US stockS -

Are you looking to diversify your investment portfolio? Have you considered investing in US Mint stocks? If not, you might be missing out on a lucrative opportunity. In this article, we'll delve into the world of US Mint stocks, exploring their benefits, risks, and how you can get started. Get ready to unlock the potential of US Mint stocks!

Understanding US Mint Stocks

First, let's clarify what US Mint stocks are. The United States Mint, established in 1792, is the sole manufacturer of legal tender coinage for the United States. While the Mint doesn't issue stocks directly, it does offer a range of products, including bullion coins, collectible coins, and numismatic items. These products can be bought and sold, creating a market for US Mint stocks.

Benefits of Investing in US Mint Stocks

Diversification: Investing in US Mint stocks can provide diversification to your portfolio, as it's not directly tied to the stock market or economic fluctuations.

Historical Value: Many US Mint products, particularly collectible coins, have a historical value that can appreciate over time. This can lead to significant returns on your investment.

Inflation-Proof: Bullion coins, such as gold and silver, can serve as a hedge against inflation. As the value of the dollar decreases, the value of these precious metals tends to increase.

Tax Advantages: Certain US Mint products, like gold and silver bullion coins, may offer tax advantages. For example, the IRS allows you to defer capital gains taxes on certain bullion coins.

Risks of Investing in US Mint Stocks

While investing in US Mint stocks can be beneficial, it's essential to be aware of the risks involved:

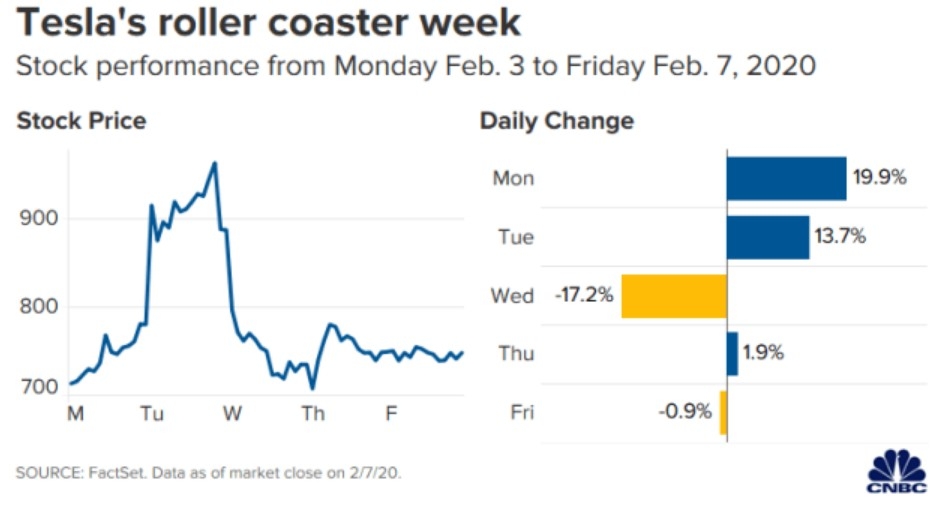

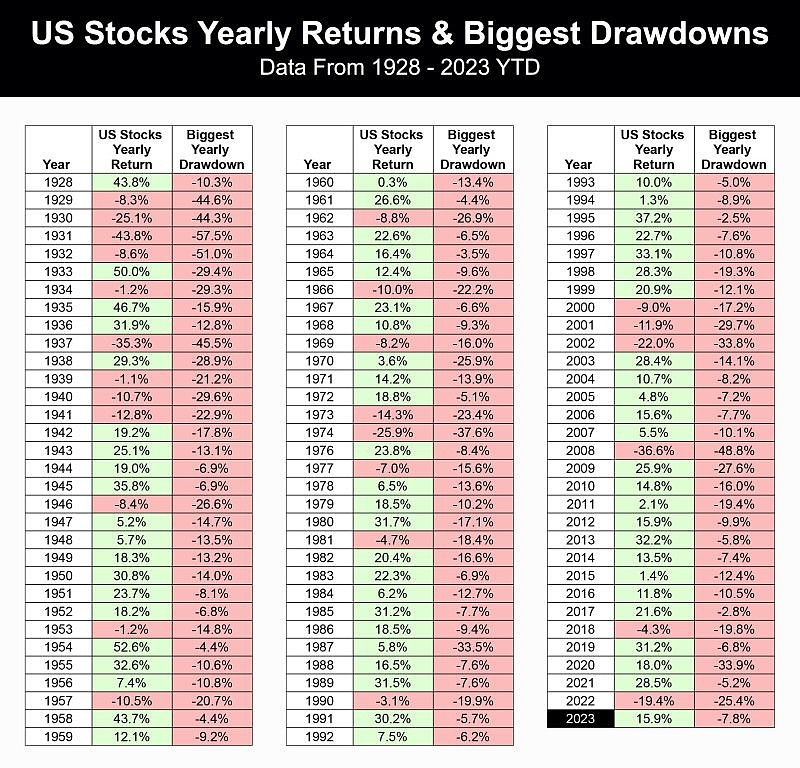

Market Fluctuations: Like any investment, US Mint stocks can be affected by market fluctuations. The value of collectible coins can be volatile, and bullion prices can fluctuate based on global economic conditions.

Storage and Insurance: Storing and insuring valuable coins and bullion can be expensive. It's crucial to consider these costs when investing in US Mint stocks.

Counterfeit Coins: There's always a risk of counterfeit coins in the market. It's essential to purchase from reputable sources to avoid falling victim to fraud.

How to Get Started

If you're ready to invest in US Mint stocks, here's how to get started:

Research: Familiarize yourself with the different types of US Mint products and their potential returns. Consider consulting with a financial advisor to help guide your investment decisions.

Choose a Reputable Source: Purchase your US Mint products from a reputable dealer or directly from the United States Mint. This ensures the authenticity and value of your investment.

Understand the Market: Keep an eye on market trends and economic indicators that can impact the value of your investment.

Stay Informed: Stay up-to-date with the latest news and developments in the US Mint industry to make informed decisions.

Case Study: The 2020 American Silver Eagle

A prime example of the potential of US Mint stocks is the 2020 American Silver Eagle. This bullion coin has seen a steady increase in value since its release, making it a wise investment for those looking to diversify their portfolio.

Conclusion

Investing in US Mint stocks can be a rewarding experience for those willing to do their research and understand the risks involved. By diversifying your portfolio, you can potentially enjoy significant returns while protecting against inflation and economic uncertainty. So, why not unlock the potential of US Mint stocks today?

dow and nasdaq today