Understanding the US Stock Market Total Market Capitalization

author:US stockS -

The US stock market total market capitalization is a critical metric that reflects the overall value of all publicly traded companies in the United States. It provides investors and analysts with a comprehensive view of the market's size and potential growth opportunities. In this article, we delve into what the total market capitalization represents, its significance, and how it impacts investment decisions.

What is Total Market Capitalization?

Total market capitalization, often referred to as market cap, is the total value of all shares of a company's stock that are currently held by investors. It is calculated by multiplying the current market price of a stock by the total number of shares outstanding. For the US stock market, the total market capitalization encompasses all publicly traded companies, including large-cap, mid-cap, and small-cap stocks.

Significance of Total Market Capitalization

Market Size and Growth: The total market capitalization of the US stock market is a reflection of its size and growth potential. A higher market cap indicates a larger and more diversified market, which can attract more investors and lead to increased liquidity.

Economic Indicator: The total market capitalization serves as an important economic indicator. It provides insights into the overall health of the economy and the stock market's performance. For instance, a rising market cap can indicate economic growth and investor confidence.

Investment Opportunities: Understanding the total market capitalization helps investors identify potential investment opportunities. By analyzing the market cap of different sectors and companies, investors can make informed decisions about where to allocate their capital.

Impact on Investment Decisions

Sector Analysis: Investors can use the total market capitalization to analyze different sectors and identify those with high growth potential. For example, technology and healthcare sectors have seen significant growth in recent years, contributing to the overall increase in the US stock market's total market capitalization.

Company Valuation: The total market capitalization can also be used to evaluate the value of individual companies. A higher market cap may indicate that a company is overvalued, while a lower market cap may suggest undervaluation.

Risk Assessment: The total market capitalization can help investors assess the risk associated with investing in a particular stock. Generally, larger companies with higher market caps are considered less risky compared to smaller companies with lower market caps.

Case Study: Tech Giants and the US Stock Market

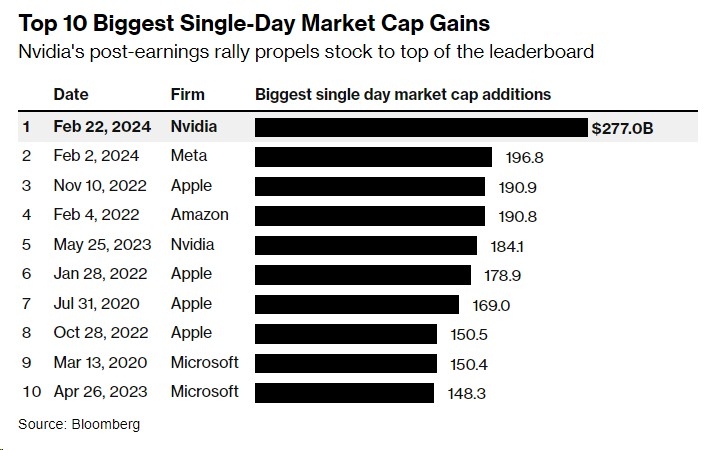

One of the key drivers behind the growth in the US stock market's total market capitalization has been the rise of tech giants such as Apple, Microsoft, and Amazon. These companies have seen significant growth in their market caps, contributing to the overall increase in the total market capitalization.

For instance, Apple's market cap reached an all-time high of over $2 trillion in 2021, making it the first company to achieve this milestone. This growth reflects the increasing importance of technology in the global economy and the attractiveness of tech stocks to investors.

In conclusion, the US stock market total market capitalization is a crucial metric that provides valuable insights into the market's size, growth potential, and investment opportunities. By understanding its significance and impact on investment decisions, investors can make more informed choices and potentially achieve better returns.

dow and nasdaq today