Understanding the Dynamics of US Marijuana Companies Stock

author:US stockS -

In recent years, the marijuana industry has seen a remarkable transformation in the United States. With several states legalizing cannabis for medical and recreational use, the market has witnessed a surge in interest from investors. The stock market has, in turn, responded with a plethora of opportunities for those looking to capitalize on this growing sector. This article delves into the intricacies of US marijuana companies stock, providing insights into the market trends, potential risks, and investment opportunities.

The Rise of Legal Marijuana

The cornerstone of the US marijuana industry is the legal landscape. Over the past decade, more than two dozen states have passed laws legalizing cannabis for medical or recreational use. This shift has not only opened up new markets for companies but has also normalized the industry, making it more attractive to investors.

Market Trends and Opportunities

One of the most significant trends in the US marijuana industry is consolidation. As the market matures, smaller players are increasingly being acquired by larger, more established companies. This consolidation is expected to continue, leading to a more streamlined and efficient industry.

Another key trend is the rise of cannabis-infused products. Edibles, topicals, and other cannabis-infused products are becoming increasingly popular among consumers, driving growth in the industry.

Investment Opportunities

For investors, there are several compelling opportunities in the US marijuana stock market. One of the most promising sectors is cultivation and manufacturing. Companies in this space are well-positioned to benefit from the increasing demand for cannabis products.

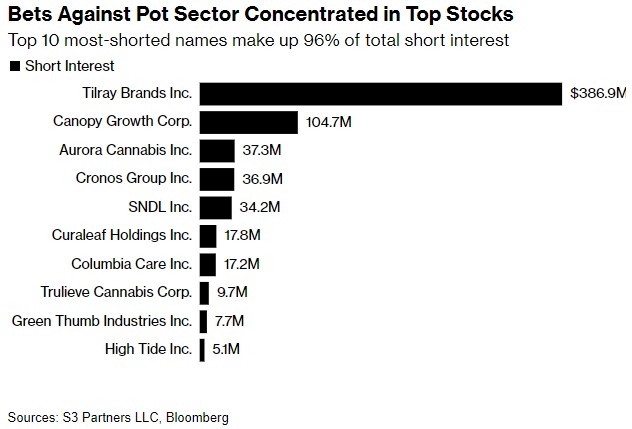

Case Study: Tilray Inc.

A notable example is Tilray Inc., a leading cannabis producer based in Canada. Tilray has successfully expanded its operations to the United States, leveraging its expertise in cannabis cultivation and processing. The company's stock has seen significant growth over the past few years, reflecting its strong market position and promising future prospects.

Risks and Challenges

While the US marijuana industry offers exciting opportunities, it also comes with its fair share of risks and challenges. One of the main risks is regulatory uncertainty. The federal government still classifies marijuana as a Schedule I drug, which poses legal and operational challenges for companies operating in the industry.

Another significant risk is competition. The market is highly fragmented, with numerous companies vying for market share. This competition can lead to price wars and erode profit margins.

Conclusion

In conclusion, the US marijuana industry presents a unique investment opportunity with significant potential for growth. However, investors should be aware of the risks and challenges associated with the industry. By conducting thorough research and staying informed about market trends, investors can make informed decisions and potentially capitalize on the growing US marijuana companies stock market.

dow and nasdaq today