US Stock Market Analysis: September 2025

author:US stockS -

Introduction

As we delve into the third quarter of 2025, the US stock market continues to evolve, offering both opportunities and challenges for investors. This comprehensive analysis will provide insights into the current state of the market, including key trends, market performance, and potential investment strategies.

Market Performance

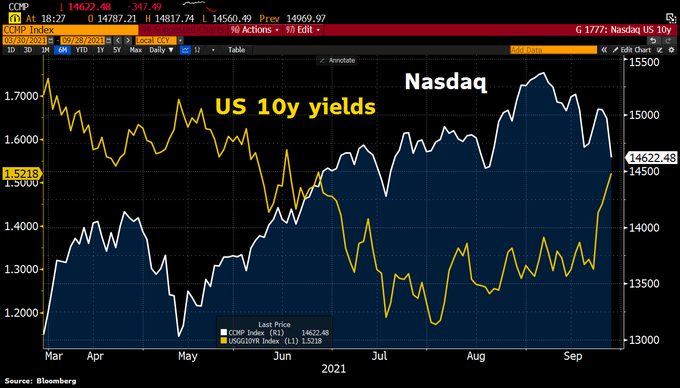

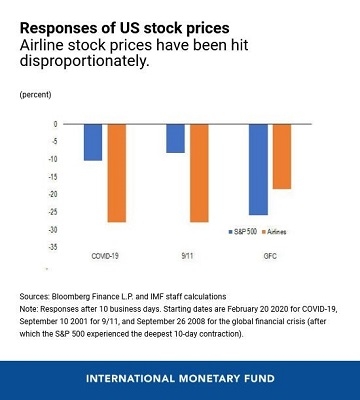

The US stock market has experienced a rollercoaster ride over the past few years. However, as we approach September 2025, the market seems to be stabilizing. The S&P 500 has seen a steady rise, driven by strong corporate earnings and favorable economic indicators. The NASDAQ, on the other hand, has been more volatile, reflecting the impact of technological advancements and regulatory changes.

Key Trends

1. Technology Sector: The technology sector remains a major driver of the US stock market. Companies like Apple, Microsoft, and Amazon continue to dominate the market, with their innovative products and robust financial performance. However, the sector has also faced challenges, including regulatory scrutiny and rising inflation.

2. Healthcare Industry: The healthcare industry has emerged as a bright spot in the stock market. With an aging population and increasing healthcare needs, companies like Johnson & Johnson and Merck have seen significant growth. Additionally, advancements in biotechnology and pharmaceuticals have opened new avenues for investment.

3. Renewable Energy: The shift towards renewable energy has been a major trend in the US stock market. Companies involved in solar and wind energy, such as Tesla and Siemens Gamesa, have seen substantial growth. This trend is expected to continue, driven by environmental concerns and government incentives.

Investment Strategies

1. Diversification: In the current market landscape, diversification is key. Investors should consider spreading their investments across various sectors and asset classes to mitigate risks. This includes a mix of stocks, bonds, and alternative investments.

2. Focus on Quality: Investing in high-quality companies with strong fundamentals can provide long-term returns. Companies with robust revenue growth, solid earnings, and strong management teams are likely to perform well in the long run.

3. Stay Informed: Keeping up-to-date with market trends and economic indicators is crucial for making informed investment decisions. This includes staying aware of political events, regulatory changes, and global economic developments.

Case Study: Tesla

Tesla, a leader in the electric vehicle (EV) market, has been a significant contributor to the US stock market. Despite facing challenges such as supply chain disruptions and increased competition, Tesla has continued to grow. The company's innovative products, strong brand, and commitment to sustainable energy have made it a favorite among investors.

Conclusion

The US stock market in September 2025 presents a complex yet promising landscape for investors. By staying informed, diversifying their portfolios, and focusing on high-quality companies, investors can navigate the market and achieve their financial goals.

dow and nasdaq today