US Large Cap Momentum Stocks: October 2025 Technical Analysis

author:US stockS -

In the dynamic world of financial markets, identifying potential opportunities within large cap momentum stocks is crucial for investors seeking growth. As we approach October 2025, it's essential to delve into the technical analysis of these stocks to understand their current trends and future potential. This article will provide a comprehensive look at the technical analysis of US large cap momentum stocks, focusing on key indicators and patterns that could influence their performance.

Understanding Large Cap Momentum Stocks

Large cap stocks refer to companies with a market capitalization of $10 billion or more. These companies are typically well-established and have a strong presence in their respective industries. Momentum stocks are shares that have shown a significant increase in price and volume over a relatively short period, often leading to substantial gains for investors.

Key Indicators for Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends that can indicate future price movements. Here are some key indicators that are commonly used in analyzing large cap momentum stocks:

- Moving Averages: These are trend-following indicators that help identify the direction of the market. Common moving averages include the 50-day and 200-day moving averages.

- Relative Strength Index (RSI): This oscillator measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: These bands are used to measure volatility and provide a range of acceptable price levels.

- Volume: Analyzing trading volume can help confirm trends and patterns in price movements.

October 2025 Technical Analysis

Moving Averages

In October 2025, the 50-day and 200-day moving averages for large cap momentum stocks are likely to play a significant role in determining their future direction. A bullish crossover (where the 50-day moving average crosses above the 200-day moving average) can indicate a strong upward trend, while a bearish crossover (where the 50-day moving average crosses below the 200-day moving average) can signal a downward trend.

Relative Strength Index (RSI)

The RSI is another crucial indicator for momentum stocks. A RSI above 70 can indicate that a stock is overbought and may be due for a pullback, while an RSI below 30 can suggest that a stock is oversold and could be ripe for a rebound.

Bollinger Bands

Bollinger Bands can help identify potential entry and exit points for trades. A breakout above the upper Bollinger Band can indicate a strong bullish trend, while a breakout below the lower Bollinger Band can suggest a bearish trend.

Volume

Analyzing trading volume is essential for confirming trends. An increase in volume during a price move can provide additional support for the trend, while a decrease in volume can indicate a lack of conviction in the trend.

Case Studies

Let's take a look at two hypothetical large cap momentum stocks in October 2025:

Tech Giant Inc.

- 50-day Moving Average: Bullish crossover

- RSI: Above 70

- Bollinger Bands: Breakout above the upper Bollinger Band

- Volume: Increasing Conclusion: Tech Giant Inc. appears to be in a strong bullish trend and may be a good investment opportunity.

Energy Producers Inc.

- 50-day Moving Average: Bearish crossover

- RSI: Below 30

- Bollinger Bands: Breakout below the lower Bollinger Band

- Volume: Decreasing Conclusion: Energy Producers Inc. appears to be in a strong bearish trend and may not be a good investment opportunity at this time.

By analyzing these technical indicators and patterns, investors can gain valuable insights into the potential performance of large cap momentum stocks in October 2025. However, it's important to remember that technical analysis is just one tool in an investor's toolkit, and it should be used in conjunction with other research and analysis methods.

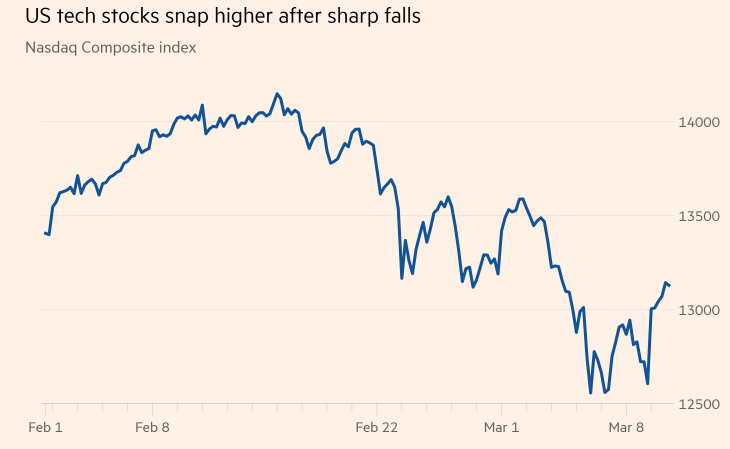

dow and nasdaq today