US Investors Grow Cautious Despite Stock Market Highs

author:US stockS -

Introduction

In the face of record-breaking stock market highs, a growing number of US investors are adopting a cautious approach. This shift in sentiment is driven by a variety of factors, including economic uncertainty, geopolitical tensions, and market volatility. This article delves into the reasons behind this cautious outlook and examines how investors are navigating these challenging times.

Economic Uncertainty

One of the primary reasons for the cautious stance among US investors is the economic uncertainty caused by the COVID-19 pandemic. Despite the recovery in the stock market, many businesses are still struggling to regain their pre-pandemic momentum. This uncertainty has led investors to question the sustainability of current market highs and prompted them to adopt a more conservative approach.

Geopolitical Tensions

Geopolitical tensions have also contributed to the cautious outlook among US investors. Issues such as trade disputes, political instability, and conflicts in various regions of the world have raised concerns about the global economic outlook. These uncertainties have made investors more hesitant to invest heavily in stocks, opting instead for safer assets such as bonds and gold.

Market Volatility

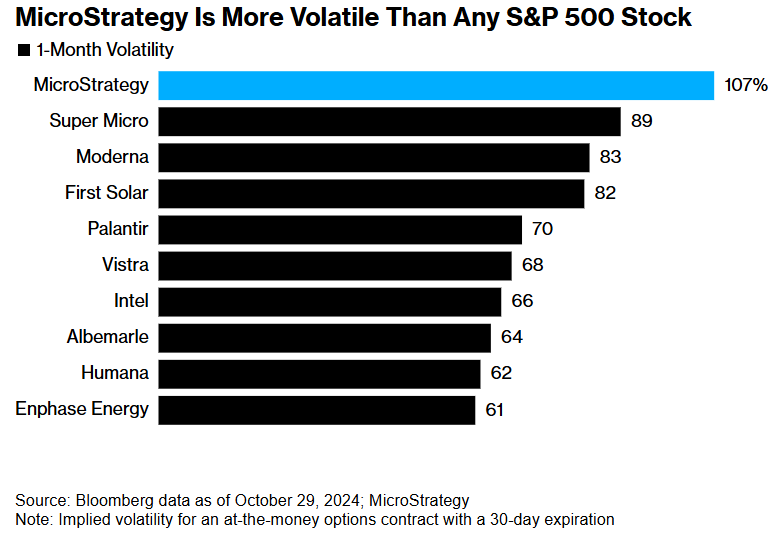

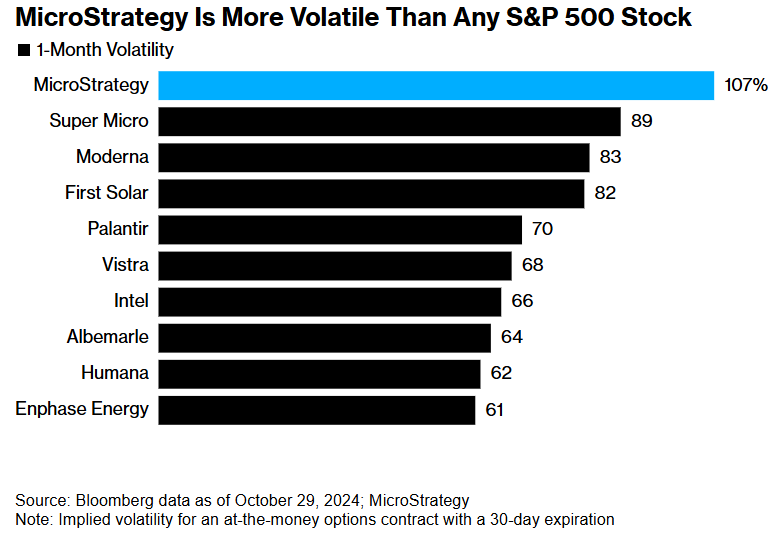

Another factor driving the cautious approach among investors is the increased market volatility. The stock market has seen significant ups and downs in recent months, with some sectors experiencing sharp declines. This volatility has made it difficult for investors to predict market trends and has led them to seek more stable investment opportunities.

Investor Behavior

The behavior of investors has also played a role in the cautious outlook. Many investors are adopting a wait-and-see approach, preferring to hold off on making significant investments until they have a clearer picture of the economic and geopolitical landscape. This behavior is reflected in the increased demand for diversified portfolios, which aim to spread risk across various asset classes.

Case Studies

To illustrate this cautious approach, consider the following case studies:

Tech Stocks: Many investors have become wary of tech stocks, which have seen significant growth in recent years. Concerns about overvaluation and potential regulatory changes have led some investors to reduce their exposure to this sector.

Real Estate: The real estate sector has also seen a cautious approach, with investors focusing on stable, income-generating properties rather than speculative investments.

Emerging Markets: Investors have become more selective in their approach to emerging markets, focusing on countries with strong economic fundamentals and stable political environments.

Conclusion

Despite the record-breaking highs in the stock market, US investors are growing cautious. This cautious outlook is driven by economic uncertainty, geopolitical tensions, and market volatility. Investors are adopting a wait-and-see approach, focusing on diversified portfolios and stable investment opportunities. As the economic and geopolitical landscape continues to evolve, it remains to be seen how investors will navigate these challenging times.

dow and nasdaq today