US Government Shutdown: Stock Market Reaction in 2025

author:US stockS -

As we delve into 2025, the possibility of a US government shutdown continues to stir concerns among investors and financial markets. A government shutdown can have significant implications for the stock market, as it affects various sectors and the overall economic landscape. This article explores the potential reactions of the stock market in the event of a US government shutdown in 2025, analyzing the historical context and potential outcomes.

Historical Perspective

Historically, US government shutdowns have had mixed reactions in the stock market. The last shutdown in December 2018, for example, lasted 35 days and resulted in a brief but noticeable dip in the stock market. However, the market quickly recovered, reflecting investors' confidence in the long-term resilience of the US economy.

Impact on Different Sectors

A government shutdown can impact various sectors in different ways. For instance:

- Healthcare: The healthcare sector, which is heavily reliant on government funding, may face disruptions during a shutdown. This could lead to delays in research and development, as well as potential job losses in the industry.

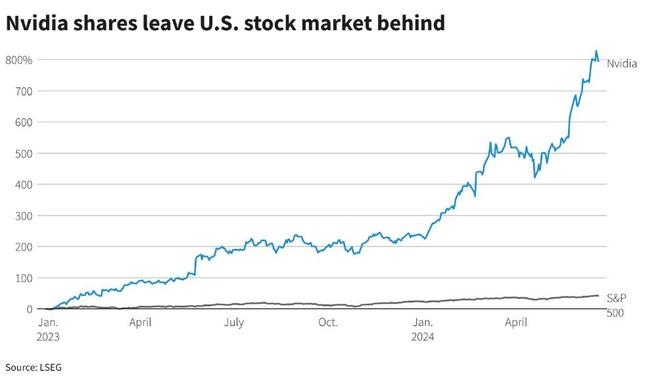

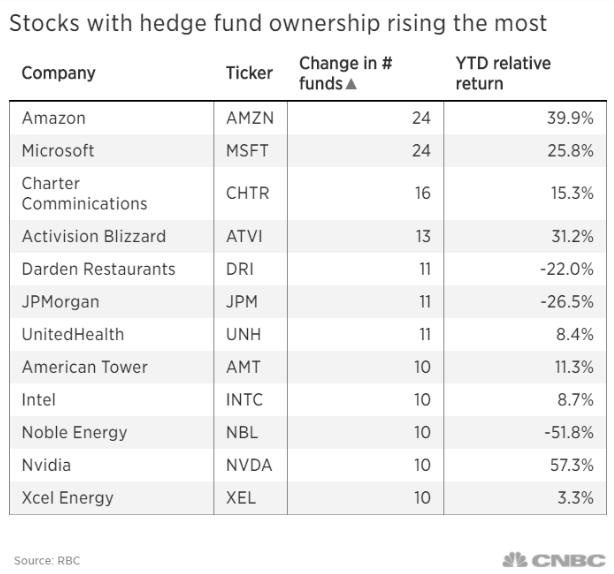

- Technology: The technology sector, on the other hand, may not be directly affected by a shutdown, but it could be indirectly impacted due to the broader economic uncertainty.

- Financial Services: The financial services sector, which relies on regulatory oversight by the government, may face disruptions if key regulatory agencies are not fully operational.

Market Reactions

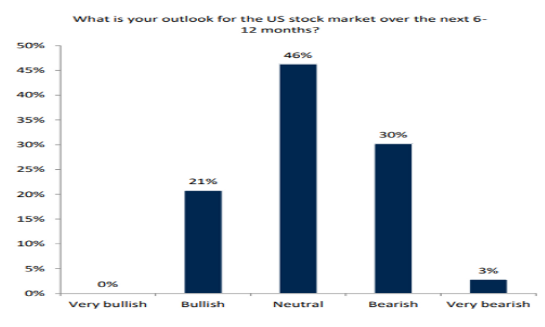

The stock market's reaction to a government shutdown can be unpredictable. However, some patterns have emerged:

- Short-Term Volatility: A government shutdown often leads to short-term volatility in the stock market. Investors may react to news and uncertainty, leading to fluctuations in stock prices.

- Long-Term Impact: Despite short-term volatility, the long-term impact of a government shutdown on the stock market is often minimal. Investors tend to focus on the broader economic outlook and the ability of the US economy to recover from the shutdown.

Case Study: December 2018 Shutdown

One notable case is the government shutdown in December 2018. The shutdown resulted in a brief downturn in the stock market, with the S&P 500 dropping by approximately 1.3%. However, the market quickly recovered, and by the end of the shutdown, the S&P 500 had gained around 0.2%.

Conclusion

While a US government shutdown in 2025 could lead to short-term volatility in the stock market, the long-term impact is likely to be minimal. Investors should focus on the broader economic outlook and the ability of the US economy to recover from any shutdown-related disruptions. As we move forward, it is crucial for investors to remain vigilant and stay informed about the latest developments in the government shutdown scenario.

dow and nasdaq today