Today's Stock Market Futures: A Comprehensive Guide

author:US stockS -

In the ever-evolving world of finance, staying ahead of the curve is crucial. One of the most effective ways to do so is by keeping a close eye on today's stock market futures. These futures can provide valuable insights into market trends and potential opportunities. In this article, we'll delve into what stock market futures are, how they work, and why they matter for investors.

Understanding Stock Market Futures

Stock market futures are financial contracts that obligate the buyer to purchase an asset at a predetermined price at a specified future date. These contracts are commonly used to speculate on the future price of an asset, such as stocks, bonds, or commodities. By doing so, investors can hedge their positions or profit from price movements.

How Stock Market Futures Work

Stock market futures are traded on futures exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). These exchanges offer a wide range of futures contracts, including those based on individual stocks, stock indexes, and commodities.

When an investor buys a stock market future, they are essentially entering into a contract with the seller. The contract specifies the asset to be purchased, the price, and the date of delivery. If the market price of the asset rises above the contract price, the buyer can profit by buying the asset at a lower price and selling it at the higher market price. Conversely, if the market price falls, the buyer can still profit by selling the contract at a higher price than the asset's current market value.

Why Stock Market Futures Matter for Investors

Keeping an eye on today's stock market futures can provide several benefits for investors:

Market Trends: Stock market futures can offer a glimpse into market trends and potential opportunities. By analyzing the movements of futures contracts, investors can gain insights into the market's sentiment and make informed decisions.

Risk Management: Futures contracts can be used to hedge against potential losses in the stock market. For example, if an investor holds a portfolio of stocks, they can buy futures contracts to offset potential losses if the market falls.

Speculation: Investors can use stock market futures to speculate on the future price of an asset. This can be a lucrative strategy, but it also comes with higher risk.

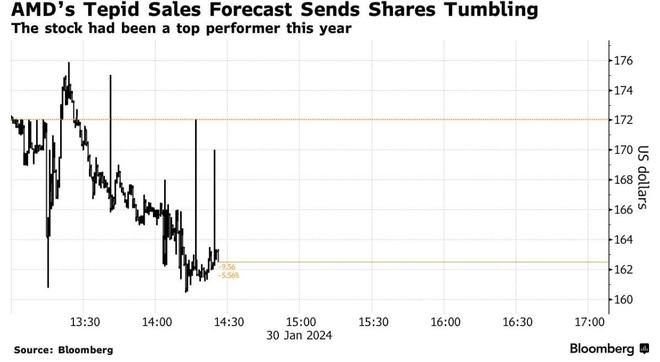

Case Study: The 2020 Stock Market Crash

One notable example of the impact of stock market futures is the 2020 stock market crash. In February 2020, the COVID-19 pandemic caused a sharp decline in stock prices. However, today's stock market futures began to show signs of a potential rebound even before the market bottomed out. Investors who paid attention to these futures were able to capitalize on the subsequent rally.

Conclusion

In conclusion, today's stock market futures are a valuable tool for investors looking to stay ahead of market trends and potential opportunities. By understanding how these futures work and why they matter, investors can make informed decisions and potentially profit from market movements. Whether you're a seasoned investor or just starting out, keeping an eye on stock market futures is a crucial part of your investment strategy.

dow and nasdaq today