Title: US Small Cap Stock: A Lucrative Investment Opportunity

author:US stockS -

Introduction: In the world of investing, small cap stocks often fly under the radar, yet they can represent a significant opportunity for investors looking to maximize returns. US small cap stocks are companies with a market capitalization of less than $2 billion, and they often offer a blend of high growth potential and relatively low prices. This article delves into the world of US small cap stocks, exploring their benefits, risks, and strategies for successful investment.

Understanding Small Cap Stocks: Small cap stocks are typically associated with smaller, less established companies that are in the early stages of growth. These companies often have limited resources and a smaller market presence compared to their larger counterparts. However, this also means they have the potential for rapid growth and significant returns.

Benefits of Investing in US Small Cap Stocks:

- High Growth Potential: Small cap stocks tend to outperform larger companies in terms of growth potential. As these companies scale up, they can experience exponential growth, leading to substantial returns for investors.

- Attractive Valuations: Small cap stocks often trade at lower prices relative to their larger counterparts. This can provide investors with a more affordable entry point and the potential for greater upside.

- Diversification: Including small cap stocks in a diversified portfolio can help mitigate risk, as these companies may perform differently from larger, more established companies.

Risks of Investing in US Small Cap Stocks:

- Volatility: Small cap stocks are generally more volatile than larger companies, meaning their prices can fluctuate widely in a short period of time.

- Liquidity: Small cap stocks may have lower trading volumes, which can make it more difficult to buy or sell shares without significantly impacting the stock price.

- Regulatory Risk: Smaller companies may face stricter regulatory scrutiny and higher compliance costs, which can impact their growth and profitability.

Strategies for Successful Investment in US Small Cap Stocks:

- Research and Due Diligence: Conduct thorough research on potential investments, including analyzing financial statements, understanding the business model, and assessing management quality.

- Diversification: Diversify your portfolio to reduce risk by investing in a variety of small cap stocks across different industries and geographic regions.

- Long-Term Perspective: Small cap stocks can take time to mature and generate significant returns. Maintain a long-term perspective and avoid reacting to short-term market fluctuations.

Case Studies:

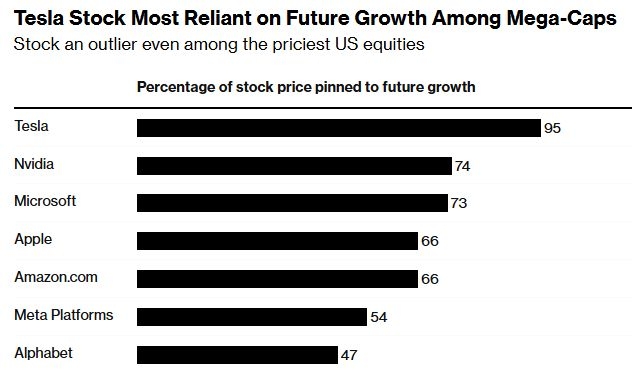

- Tesla (TSLA): Once a small cap stock, Tesla has experienced exponential growth and now has a market capitalization of over $1 trillion. Investing in Tesla at its early stages could have resulted in substantial returns.

- Facebook (now Meta Platforms, Inc. – FB): Before its initial public offering, Facebook was a small cap stock with immense growth potential. Investors who recognized this early on could have seen significant gains.

Conclusion: US small cap stocks offer a unique opportunity for investors seeking high growth potential and attractive valuations. While they come with their own set of risks, a well-researched and diversified approach can help maximize returns and mitigate potential losses. By understanding the benefits and risks, investors can make informed decisions and potentially capitalize on the growth potential of small cap stocks.

dow and nasdaq today