Tim Hortons US Stock: A Comprehensive Analysis

author:US stockS -

In the world of fast-food franchises, Tim Hortons has made a significant mark, especially in the United States. The Canadian coffee and doughnut chain has been expanding its presence in the US, and investors are keen to know how its US stock is performing. This article delves into the various aspects of Tim Hortons US stock, including its performance, growth potential, and factors influencing its stock price.

Understanding Tim Hortons US Stock

Tim Hortons, known for its "double-doubles" and "donut holes," has been a popular choice among coffee and doughnut lovers in the US. The company's US stock, listed as THI on the New York Stock Exchange, has seen a rollercoaster ride over the years. Understanding its performance requires analyzing various factors, including revenue growth, market share, and expansion plans.

Revenue Growth and Market Share

Tim Hortons has been witnessing steady revenue growth in the US. According to a recent report, the company's revenue in the US increased by 4% in the last fiscal year. This growth can be attributed to the company's expansion strategy and the increasing popularity of its products. Tim Hortons has been successful in capturing a significant market share in the US coffee and doughnut industry, thanks to its unique offerings and strong brand presence.

Expansion Plans and Growth Potential

Tim Hortons has ambitious expansion plans in the US. The company aims to open more locations in key markets, including New York, Florida, and California. This expansion is expected to drive the company's revenue and increase its market share. Moreover, Tim Hortons is also focusing on digital transformation, which is expected to enhance customer experience and drive sales.

Factors Influencing Tim Hortons US Stock

Several factors influence the performance of Tim Hortons US stock. Here are some of the key factors:

- Economic Conditions: Economic downturns can impact consumer spending, which, in turn, can affect Tim Hortons' revenue and stock price.

- Competition: The coffee and doughnut industry is highly competitive, with major players like Starbucks and Dunkin' Donuts vying for market share. Tim Hortons needs to stay competitive to maintain its market position.

- Operational Efficiency: Tim Hortons' operational efficiency plays a crucial role in its profitability. The company needs to optimize its supply chain and reduce costs to enhance its bottom line.

- Regulatory Changes: Changes in regulations, especially in the food and beverage industry, can impact Tim Hortons' operations and profitability.

Case Studies

To illustrate the impact of these factors on Tim Hortons US stock, let's consider two case studies:

- Economic Downturn: During the 2008 financial crisis, Tim Hortons' revenue and stock price took a hit. However, the company managed to recover quickly by focusing on operational efficiency and cost reduction.

- Competition: When Dunkin' Donuts announced its plan to expand its coffee offerings, Tim Hortons faced increased competition. However, the company managed to maintain its market share by introducing new products and enhancing customer experience.

Conclusion

Tim Hortons US stock has been performing well, driven by steady revenue growth, expansion plans, and a strong brand presence. However, investors need to keep an eye on factors like economic conditions, competition, and operational efficiency to make informed decisions. As Tim Hortons continues to expand in the US, its stock is expected to remain a key focus for investors.

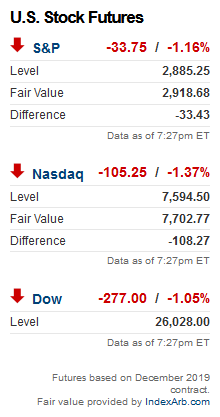

dow and nasdaq today