Tap Us Stock: The Ultimate Guide to Unlocking Investment Opportunities

author:US stockS -

Are you looking to dive into the world of stock investing? If so, you've come to the right place. "Tap Us Stock" is more than just a catchy phrase; it's a comprehensive guide to help you navigate the stock market with confidence. In this article, we'll explore the ins and outs of investing in stocks, including the basics, strategies, and tips to help you make informed decisions.

Understanding the Stock Market

First things first, let's get a clear understanding of what the stock market is. The stock market is a platform where shares of publicly-traded companies are bought and sold. When you invest in a stock, you're essentially buying a small piece of that company. The value of your investment can increase or decrease based on the company's performance and market conditions.

The Basics of Investing in Stocks

Research: Before diving into the stock market, it's crucial to do your homework. Research the companies you're interested in, their financial statements, and industry trends. This will help you make informed decisions and avoid potential pitfalls.

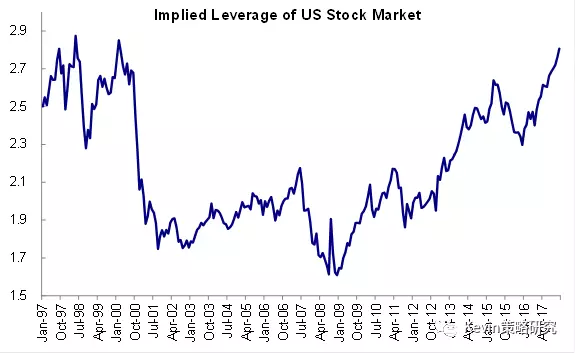

Risk Management: Investing in stocks comes with risks, and it's important to understand and manage them. Diversify your portfolio by investing in a variety of stocks across different industries and geographical locations. This will help mitigate the impact of any single stock's performance on your overall investment.

Long-Term Approach: While short-term gains can be enticing, a long-term approach is often the most rewarding. Stocks can be volatile in the short term, but over the long term, they tend to provide solid returns.

Strategies for Success

Value Investing: This strategy involves identifying undervalued stocks and holding them for the long term. Value investors look for companies with strong fundamentals and a low price-to-earnings ratio.

Growth Investing: Growth investors seek out companies with high potential for future growth. These companies often have strong revenue and profit growth, but may be more volatile in the short term.

Dividend Investing: Dividend investors focus on companies that pay regular dividends. This can provide a steady stream of income and can be a good way to preserve capital.

Top Tips for Success

Stay Informed: Keep up with the latest news and trends in the stock market. This will help you stay ahead of potential opportunities and risks.

Use Stop-Loss Orders: A stop-loss order is an instruction to sell a stock when it reaches a certain price. This can help protect your investment from significant losses.

Avoid Emotional Investing: Avoid making impulsive decisions based on emotions. Stick to your investment plan and stay focused on your long-term goals.

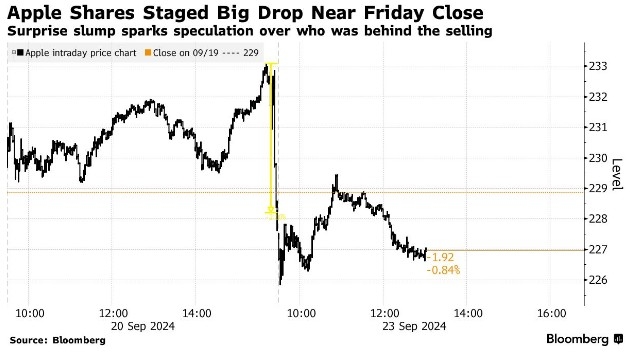

Case Study: Apple Inc.

A prime example of a successful stock investment is Apple Inc. (AAPL). When Apple went public in 1980, the stock was priced at

In conclusion, "Tap Us Stock" is your go-to guide for navigating the stock market. By understanding the basics, adopting a strategic approach, and staying informed, you can unlock the potential for significant investment opportunities. Remember, investing in stocks requires patience, discipline, and a long-term perspective. Happy investing!

dow and nasdaq today