Stocks Raised to Buy US: A Strategic Investment Guide

author:US stockS -

Investing in the US market can be a game-changer for your portfolio. However, finding the right stocks to buy requires a strategic approach. This guide will help you understand how to raise funds to invest in US stocks, ensuring a diversified and profitable investment portfolio.

Understanding the US Stock Market

The US stock market is known for its stability, liquidity, and vast array of investment opportunities. From tech giants like Apple and Microsoft to established companies like General Electric, the US market offers a wide range of investment options.

Raising Funds for US Stocks

To invest in US stocks, you need to raise funds. Here are some common ways to do so:

Personal Savings: The simplest way to raise funds is by using your personal savings. Set aside a portion of your income regularly and build a savings cushion.

Retirement Accounts: 401(k), IRA, and other retirement accounts can be excellent sources of funds for long-term investments. Take advantage of tax-deferred growth and consider investing a portion of your retirement funds in US stocks.

Selling Assets: Selling assets such as real estate, cars, or jewelry can provide a significant amount of funds for investing. Ensure that you carefully evaluate the potential returns before selling any assets.

Borrowing: While borrowing money for investments can be risky, it can also be a viable option. Consider taking out a personal loan or using a home equity line of credit to raise funds for your investments.

Selecting US Stocks to Invest In

Once you have raised the necessary funds, the next step is to select the right US stocks. Here are some key factors to consider:

Research and Analysis: Conduct thorough research and analysis on the companies you are interested in. Look at their financial statements, earnings reports, and market trends.

Sector and Industry: Consider the sector and industry of the company. Some sectors, like technology and healthcare, tend to be more volatile, while others, like utilities and consumer goods, are more stable.

Growth and Dividends: Look for companies with a strong track record of growth and dividends. Companies that consistently increase their earnings and pay dividends can provide a solid return on investment.

Risk Tolerance: Assess your risk tolerance and invest accordingly. Some stocks may offer higher returns but come with higher risk, while others may provide more stable returns but with lower growth potential.

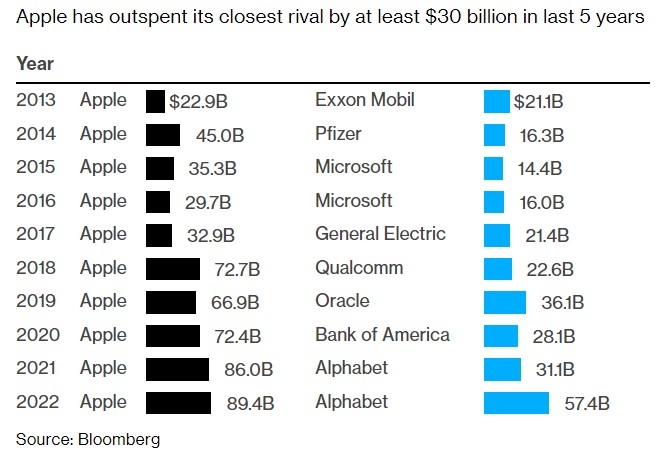

Case Study: Apple Inc.

Consider Apple Inc., a leading technology company. Over the years, Apple has consistently demonstrated strong growth and has paid dividends to its shareholders. By investing in Apple stock, investors have seen significant returns on their investments.

Conclusion

Investing in US stocks can be a rewarding endeavor. By understanding how to raise funds, conducting thorough research, and considering key factors, you can build a diversified and profitable investment portfolio. Remember to stay informed and make strategic decisions to maximize your returns.

dow and nasdaq today