Stock Buying: A Comprehensive Guide to Successful Investments

author:US stockS -

In today's fast-paced financial market, stock buying has become a popular way for individuals and institutions to grow their wealth. However, navigating the complexities of the stock market can be daunting for beginners. This article aims to provide a comprehensive guide to stock buying, covering everything from basic concepts to advanced strategies.

Understanding the Basics of Stock Buying

Before diving into the world of stock buying, it's crucial to have a solid understanding of the basics. A stock represents a share in the ownership of a company. When you buy stocks, you're essentially purchasing a small piece of that company. The value of your investment will fluctuate based on the company's performance and market conditions.

Types of Stocks

There are several types of stocks to consider when you're ready to start stock buying:

- Common Stocks: These are the most common type of stock, offering voting rights and the potential for dividends.

- Preferred Stocks: These stocks do not offer voting rights but provide fixed dividends, making them a more stable investment.

- Blue-Chip Stocks: These are shares of well-established, financially stable companies with a strong track record.

- Growth Stocks: These stocks belong to companies with high growth potential, often at the expense of current dividends.

The Stock Buying Process

The process of stock buying is relatively straightforward. Here's a step-by-step guide:

- Research: Conduct thorough research on the companies you're interested in. Look at their financial statements, revenue growth, market share, and competitive position.

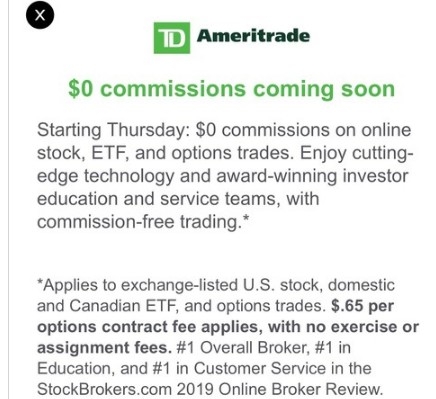

- Open a Brokerage Account: You'll need a brokerage account to buy and sell stocks. Compare different brokers based on fees, customer service, and available investment options.

- Choose Your Stocks: Based on your research and investment goals, select the stocks you want to buy.

- Place an Order: Once you've decided on your stocks, place an order with your brokerage firm. You can choose to buy stocks at the market price or set a limit order to buy at a specific price.

- Monitor Your Investments: Regularly review your investments to ensure they align with your investment goals and adjust your strategy as needed.

Advanced Strategies for Successful Stock Buying

To maximize your returns on stock buying, consider the following advanced strategies:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different sectors, industries, and geographical locations.

- Technical Analysis: Learn to analyze stock charts and identify trends that can help you make informed decisions.

- Fundamental Analysis: Understand the financial health of a company by analyzing its balance sheet, income statement, and cash flow statement.

- Risk Management: Always use stop-loss orders to protect your investments from sudden market downturns.

Case Study: Apple Inc.

Let's take a look at a real-world example of stock buying. Apple Inc. (AAPL) is a well-known example of a successful stock investment. In 2012, the company's stock was trading at around

Conclusion

Stock buying can be a powerful tool for building wealth, but it requires research, discipline, and a long-term perspective. By understanding the basics, following a sound strategy, and staying informed, you can navigate the stock market with confidence. Remember, successful stock buying is not about making a quick buck but about building a diversified portfolio that aligns with your investment goals.

dow and nasdaq today