Singapore-US Stock Tax: Understanding the Implications and Impact

author:US stockS -

In recent years, the relationship between the United States and Singapore has grown increasingly significant, particularly in the realm of international finance. One of the most notable developments has been the introduction of the Singapore-US stock tax. This new tax regulation has far-reaching implications for companies and investors on both sides of the Pacific. In this article, we delve into the details of the Singapore-US stock tax, its potential impact, and what it means for those involved in cross-border investments.

What is the Singapore-US Stock Tax?

The Singapore-US stock tax is a new tax regulation implemented by the Singaporean government, targeting American companies listed on Singaporean stock exchanges. This tax aims to ensure that these companies pay their fair share of taxes in both countries, avoiding double taxation and profit shifting.

How Does the Tax Work?

Under the Singapore-US stock tax, American companies listed on Singaporean exchanges will be subject to a 15% tax on their undistributed earnings. This tax is levied on the portion of profits that are not reinvested in the business or distributed to shareholders. The intention behind this tax is to prevent companies from avoiding taxes by routing profits through Singapore, a known tax haven.

The Implications for Companies

The introduction of the Singapore-US stock tax has raised concerns among American companies operating in Singapore. Many companies have expressed fears that this tax could deter foreign investment and negatively impact their bottom line. However, it's important to note that the tax only applies to undistributed earnings and not to the overall profits of the company.

The Impact on Investors

For investors, the Singapore-US stock tax could have several implications. Firstly, it may lead to increased costs for American companies listed in Singapore, potentially affecting their stock prices. Secondly, investors may need to reassess their portfolios and consider the tax implications of holding stocks in companies affected by the tax.

Case Studies

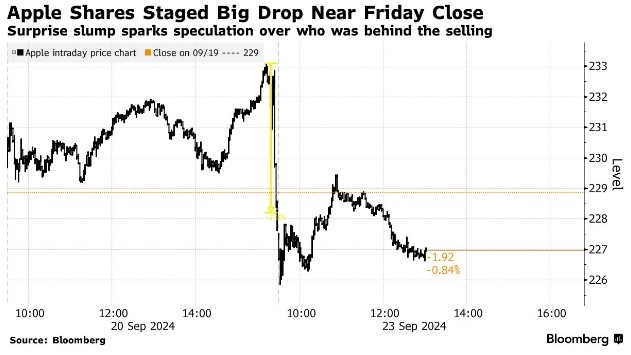

One notable case is that of Apple Inc., which has significant operations in Singapore. While the company has not yet been directly impacted by the Singapore-US stock tax, it has raised concerns about the potential tax implications. Another example is that of Facebook Inc., which is listed on both the NASDAQ and the Singapore Exchange. The tax could affect Facebook's earnings, particularly if the company decides to distribute dividends.

Conclusion

The Singapore-US stock tax is a significant development in the realm of international finance. While it may raise concerns for American companies and investors, it also serves as a reminder of the importance of tax transparency and fairness in global trade. As the situation evolves, it will be crucial for all stakeholders to stay informed and adapt to the changing landscape of international taxation.

dow and nasdaq today