Real Estate vs. Stocks: Which Investment is Right for You?

author:US stockS -

In the world of investing, the debate between real estate and stocks has been a long-standing one. Both offer unique benefits and risks, and deciding which one is right for you depends on your financial goals, risk tolerance, and investment horizon. In this article, we'll explore the key differences between real estate and stocks, helping you make an informed decision for your investment portfolio.

Understanding Real Estate Investments

Real estate investments involve purchasing properties such as houses, apartments, or commercial buildings. These investments offer several advantages:

- Potential for High Returns: Real estate can generate significant income through rental payments, property appreciation, and the potential for flipping properties.

- Leverage: Investors can use leverage to purchase properties with a smaller upfront investment, using borrowed funds.

- Physical Asset: Real estate is a tangible asset that can provide a sense of security and control.

However, real estate investments also come with their own set of risks:

- Liquidity: Real estate is not as liquid as stocks, making it more challenging to sell quickly.

- Maintenance and Management: Owning physical property requires ongoing maintenance and management, which can be time-consuming and costly.

- Market Fluctuations: Real estate markets can be unpredictable, and property values can fluctuate based on various factors such as location, economic conditions, and supply and demand.

Understanding Stock Investments

Stock investments involve purchasing shares of a company. These investments offer several advantages:

- Liquidity: Stocks are highly liquid, allowing investors to buy and sell shares quickly without significant impact on price.

- Diversification: Investors can diversify their portfolios by investing in a variety of stocks across different industries and sectors.

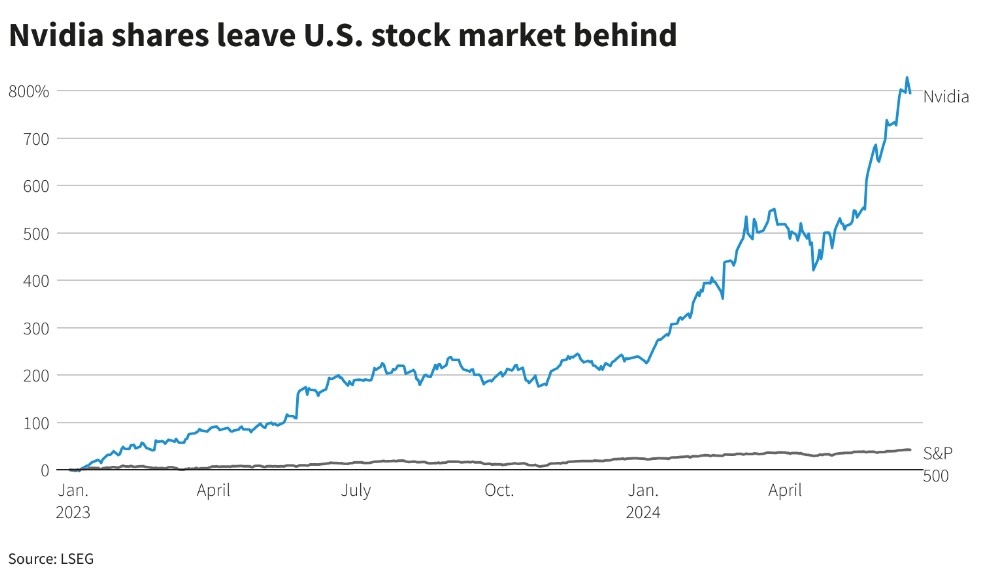

- Potential for High Growth: Stocks can offer high growth potential, as the value of shares can increase significantly over time.

However, stock investments also come with their own set of risks:

- Market Volatility: Stock prices can be highly volatile, leading to significant fluctuations in value.

- Liquidity Risk: While stocks are generally liquid, certain stocks, especially those of smaller companies, may have lower liquidity.

- Dividend Risk: Investors may not receive dividends, depending on the company's financial situation and dividend policy.

Comparing Real Estate and Stocks

When comparing real estate and stocks, it's essential to consider several factors:

- Risk Tolerance: Real estate investments tend to be less volatile than stocks but may require a higher risk tolerance due to the potential for market fluctuations and property depreciation.

- Investment Horizon: Real estate investments typically require a longer time horizon, while stocks can be more suitable for short-term investments.

- Diversification: Both real estate and stocks offer diversification opportunities, but the level of diversification may vary depending on the specific investments.

Case Studies

To illustrate the differences between real estate and stocks, let's consider two case studies:

- Real Estate Case Study: An investor purchases a rental property for

200,000, using a 20% down payment. Over the next five years, the property appreciates by 10%, and the investor earns 1,200 per month in rental income. The investor decides to sell the property, realizing a profit of $40,000. - Stock Case Study: An investor purchases 100 shares of a company for

50 per share. Over the next five years, the stock price increases to 100 per share, and the investor decides to sell, realizing a profit of $30,000.

Both investments generated a profit, but the real estate investment required a higher upfront investment and a longer time horizon. The stock investment, on the other hand, was more liquid and had a shorter time horizon.

In conclusion, both real estate and stocks offer unique investment opportunities, and the right choice depends on your individual circumstances. By understanding the key differences between these two investment types, you can make an informed decision for your investment portfolio.

dow and nasdaq today