President Trump's Tariff Threats on China Rattle US Stocks

author:US stockS -

In a volatile market, President Trump's tariff threats on China have sent shockwaves through the US stock market. As the world's two largest economies, the tensions between the US and China have a significant impact on global trade and investment. This article delves into the implications of these tariff threats and their effects on US stocks.

Understanding the Tariff Threats

President Trump's administration has been vocal about imposing tariffs on Chinese goods. The rationale behind these tariffs is to address what the administration believes are unfair trade practices by China. The proposed tariffs are aimed at a wide range of products, including electronics, steel, and textiles.

Impact on US Stocks

The uncertainty surrounding these tariff threats has caused investors to pull back on their investments. Several sectors have been particularly affected, including technology, automotive, and retail. Here's a closer look at how these sectors have been impacted:

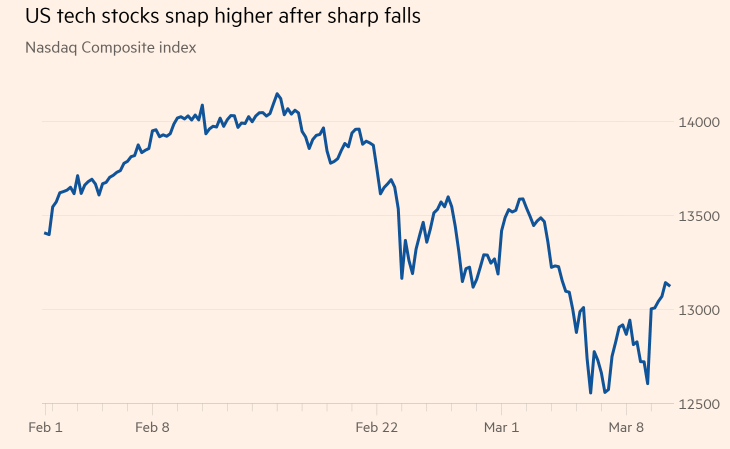

- Technology Sector: The technology sector, which is heavily reliant on Chinese suppliers, has been hit hard. Companies like Apple and Microsoft, which have significant operations in China, have seen their stocks decline as investors worry about the potential impact of higher tariffs on their supply chains.

- Automotive Sector: The automotive sector is also under pressure. Automakers like Ford and General Motors have warned that the proposed tariffs could lead to higher prices for consumers and impact their bottom lines.

- Retail Sector: The retail sector has also been affected. Companies like Walmart and Target, which rely on Chinese suppliers for a significant portion of their goods, have seen their stocks decline as investors worry about the potential impact of higher prices for consumers.

Case Studies

To illustrate the impact of these tariff threats, let's look at a few case studies:

- Apple: Apple has warned that the proposed tariffs could increase the cost of its products by up to $200. This has led to concerns about a potential decline in sales, particularly in China, which is one of Apple's largest markets.

- General Motors: General Motors has warned that the proposed tariffs could cost the company up to $1 billion. This has led to concerns about the company's ability to maintain its profitability in the face of higher costs.

- Walmart: Walmart has warned that the proposed tariffs could lead to higher prices for consumers. This has led to concerns about the company's ability to maintain its competitive edge in the retail market.

Conclusion

The tariff threats by President Trump on China have sent shockwaves through the US stock market. The uncertainty surrounding these threats has caused investors to pull back on their investments, particularly in sectors heavily reliant on Chinese suppliers. As the situation unfolds, it remains to be seen how these tariff threats will impact the US economy and the stock market.

dow and nasdaq today