Paytm Stock in the US: A Comprehensive Guide

author:US stockS -

In today's digital age, the rise of mobile payment platforms has revolutionized the way we conduct financial transactions. One such platform, Paytm, has gained significant traction both in India and globally. For investors looking to diversify their portfolios, understanding the Paytm stock in the US market is crucial. This article delves into the details, providing a comprehensive guide to investing in Paytm stock outside of India.

Understanding Paytm and Its Market Presence

Paytm, founded in 2010 by Vijay Shekhar Sharma, is a digital payments platform based in India. It operates as a mobile wallet and offers a variety of financial services, including mobile recharges, bill payments, and online shopping. The platform has expanded its offerings to include insurance, travel, and even stock market investments.

Paytm's Global Expansion

Recognizing the potential of its platform, Paytm has been actively expanding its presence globally. The company has made significant strides in the US market, where it offers services through its partnership with One97 Communications, the parent company of Paytm.

Investing in Paytm Stock in the US

For investors interested in buying Paytm stock in the US, it's important to understand the process and potential risks involved. Here's a breakdown:

1. Accessing Paytm Stock in the US

Paytm stock is not directly listed on any US stock exchanges. However, investors can gain exposure to Paytm through various means:

- ADRs (American Depositary Receipts): Paytm's parent company, One97 Communications, has issued ADRs that trade on the NASDAQ under the ticker symbol "ONECF." This allows US investors to buy Paytm stock indirectly.

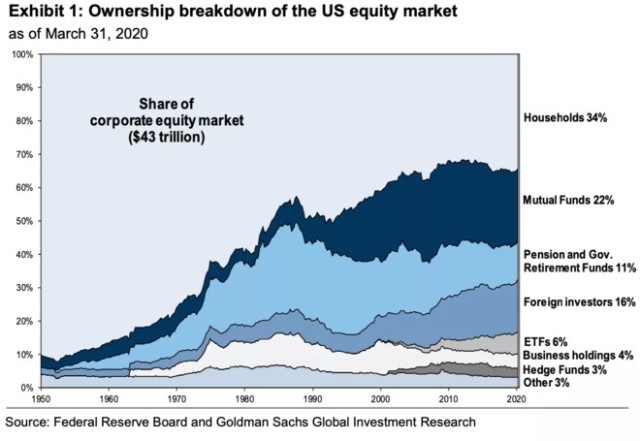

- ETFs and Mutual Funds: Some exchange-traded funds (ETFs) and mutual funds include exposure to Paytm through their holdings. This is a more diversified way to invest in Paytm without directly purchasing the stock.

2. Risks and Considerations

Investing in Paytm stock in the US comes with its own set of risks:

- Regulatory Environment: The US regulatory environment for digital payments is constantly evolving, which can impact Paytm's operations.

- Cultural Differences: Paytm's business model may face challenges adapting to the US market, which has a different consumer behavior and regulatory landscape.

- Volatility: Paytm stock, like any other stock, can be volatile, particularly in the early stages of its US market presence.

Case Study: Paytm's US Expansion

One notable case study is Paytm's partnership with Walmart to offer mobile payment solutions in the US. This partnership showcases Paytm's efforts to expand its global reach and adapt to different markets.

Conclusion

Investing in Paytm stock in the US offers a unique opportunity for investors to gain exposure to one of the fastest-growing digital payment platforms globally. However, it's important to conduct thorough research and consider the associated risks before making any investment decisions.

dow and nasdaq today