Main Index US Stock Market: A Comprehensive Overview

author:US stockS -

The main index US stock market is a crucial barometer for investors and traders worldwide. It reflects the overall health and performance of the American stock market, offering valuable insights into the economic trends and potential investment opportunities. In this article, we will delve into the main indexes of the US stock market, their significance, and how they impact investors' decisions.

The S&P 500 Index

The S&P 500 Index is one of the most widely followed and respected stock market indexes in the world. It consists of 500 large-cap companies from various sectors, representing approximately 80% of the total market capitalization of the US stock market. This index serves as a benchmark for the overall performance of the US stock market and is often used to gauge the health of the American economy.

Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is another iconic stock market index, encompassing 30 large-cap companies from diverse sectors, including finance, technology, and consumer goods. The DJIA has been in existence since 1896 and is one of the oldest and most recognized stock market indexes. It provides a snapshot of the US stock market's performance and is often used as a gauge for the stock market's overall health.

NASDAQ Composite Index

The NASDAQ Composite Index is a broad-based index that includes all domestic and international common stocks listed on the NASDAQ Stock Market. It is one of the most important indexes for technology companies, as it includes major players like Apple, Microsoft, and Google. The NASDAQ Composite Index is a valuable tool for investors looking to gain exposure to the technology sector and the broader US stock market.

Impact of Main Indexes on Investors

Understanding the main indexes of the US stock market is crucial for investors, as these indexes provide a clear picture of the market's direction and potential opportunities. Here are some key points to consider:

Investment Decisions: Investors often use these indexes to make informed decisions about their investments. For instance, if the S&P 500 Index is rising, it may indicate a strong market and a good time to invest in stocks.

Market Trends: By analyzing the performance of these indexes, investors can gain insights into market trends and economic conditions. For example, a rising DJIA may suggest a healthy economy, while a falling NASDAQ Composite Index may indicate a downturn in the technology sector.

Risk Management: Main indexes can help investors manage their risks by providing a clear picture of the market's direction. Investors can adjust their portfolios based on the performance of these indexes to avoid potential losses.

Case Studies

To illustrate the impact of the main indexes on the US stock market, let's consider a few case studies:

2020 Stock Market Crash: The COVID-19 pandemic led to a significant downturn in the stock market, with the S&P 500 Index falling by nearly 30% in March 2020. However, the index recovered quickly, gaining approximately 20% by the end of the year.

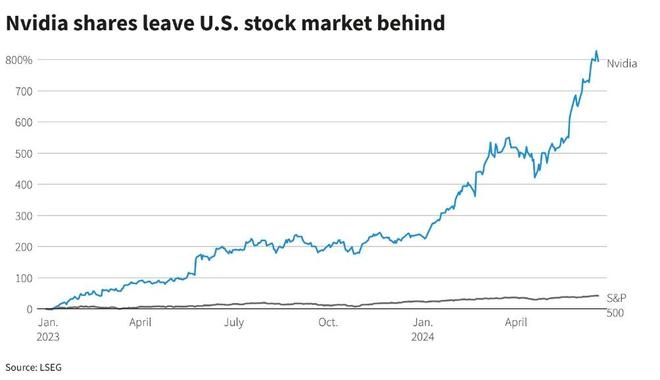

Tech Sector Boom: The NASDAQ Composite Index has experienced significant growth over the past decade, driven by the success of technology companies like Apple and Microsoft. This growth has made the NASDAQ a popular choice for investors looking to invest in the technology sector.

In conclusion, understanding the main indexes of the US stock market is essential for investors and traders. These indexes provide valuable insights into the market's direction and potential opportunities, helping investors make informed decisions. By analyzing the performance of these indexes, investors can gain a better understanding of market trends and economic conditions, ultimately leading to more successful investments.

dow and nasdaq today