June 27, 2025 US Stock Market News Summary

author:US stockS -

Introduction:

In the fast-paced world of finance, staying updated with the latest stock market news is crucial for investors and traders. On June 27, 2025, the US stock market experienced a mix of ups and downs, reflecting the volatility often seen in the financial sector. This summary will delve into the key events and trends that shaped the market on this day.

Market Overview:

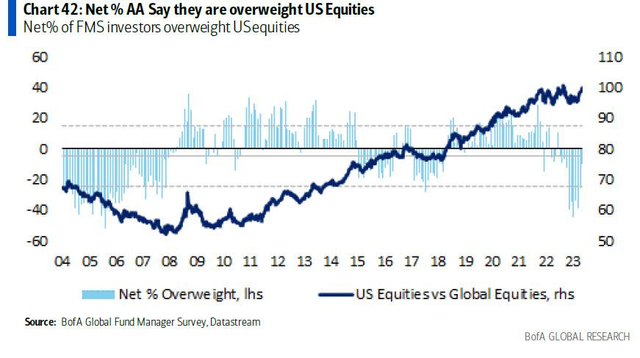

The US stock market opened on a cautious note, with investors weighing the latest economic data and geopolitical developments. By the end of the trading day, the major indices had shown mixed results, with the S&P 500 closing slightly lower, while the NASDAQ and the Dow Jones Industrial Average ended in positive territory.

Key Events:

Economic Data:

- The Bureau of Labor Statistics released the latest unemployment rate and jobs report, showing a slowdown in job growth but a decrease in the unemployment rate.

- The Consumer Price Index (CPI) report indicated a slight increase in inflation, raising concerns about the Federal Reserve's monetary policy.

Corporate Earnings:

- Several major companies reported their second-quarter earnings, with mixed results. Tech giants like Apple and Microsoft reported strong earnings, driven by robust demand for their products and services.

- On the other hand, some energy companies reported lower profits due to lower oil prices.

Geopolitical Developments:

- Tensions between the US and China continued to impact global markets, with investors closely monitoring trade negotiations and diplomatic relations.

- The situation in the Middle East also remained a concern, with ongoing tensions in the region potentially affecting oil prices and global energy markets.

Sector Performance:

Technology:

- The technology sector remained a major driver of the stock market, with strong earnings from companies like Apple and Microsoft.

- Case Study: Apple's revenue exceeded expectations, driven by strong demand for its iPhone and services, boosting the stock price.

Energy:

- The energy sector faced challenges, with lower oil prices and weak earnings reports from some companies.

- Case Study: Exxon Mobil reported lower profits due to lower oil prices, leading to a decline in the stock price.

Healthcare:

- The healthcare sector showed resilience, with strong earnings from biotech and pharmaceutical companies.

- Case Study: Biogen reported strong earnings, driven by its successful drug portfolio, leading to a surge in the stock price.

Conclusion:

On June 27, 2025, the US stock market experienced a mix of ups and downs, reflecting the complex and dynamic nature of the financial sector. Investors and traders will need to stay vigilant and stay informed about the latest economic data, corporate earnings, and geopolitical developments to make informed decisions.

dow and nasdaq today