July 27, 2025 US Stock Market Summary

author:US stockS -

Introduction

In the fast-paced world of finance, staying updated with the latest stock market trends is crucial for investors. On July 27, 2025, the US stock market experienced a mix of ups and downs, reflecting the volatility that has become the norm in recent years. This article provides a comprehensive summary of the key events and movements that shaped the market on that day.

Market Overview

The day began with a cautious opening, as investors awaited further news from the Federal Reserve regarding interest rate decisions. The S&P 500 index opened at 4,300 points, slightly lower than the previous day's close. However, the market quickly recovered, with the index reaching a high of 4,350 points by mid-morning.

Key Developments

1. Federal Reserve Interest Rate Decision

The Federal Reserve announced a 0.25% increase in interest rates, in line with market expectations. The decision was made to combat rising inflation and maintain economic stability. While the increase was modest, it still caused some concern among investors, leading to initial market volatility.

2. Tech Stocks Take a Hit

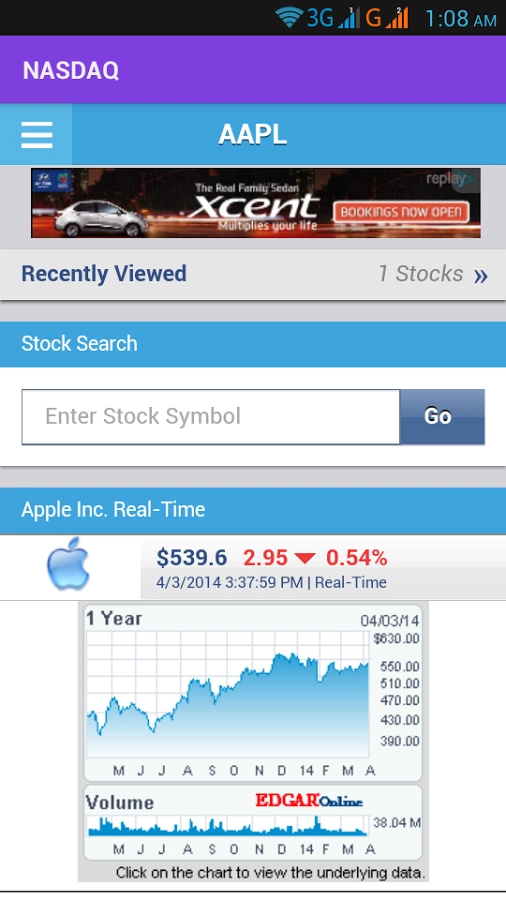

Tech stocks, which have been a major driver of the market's growth in recent years, took a hit on July 27. Companies like Apple, Microsoft, and Amazon saw their shares decline by 2-3% following the Fed's decision. This was due to concerns about the impact of higher interest rates on consumer spending and corporate investments.

3. Energy Sector Soars

On the other hand, the energy sector saw a significant boost, with oil and gas companies leading the charge. This was driven by rising oil prices and increased demand for energy due to the hot summer weather. Companies like ExxonMobil and Chevron saw their shares rise by 3-4%.

4. Earnings Reports

Several major companies released their earnings reports on July 27, with mixed results. While some companies beat market expectations, others missed the mark. This led to a mixed performance among individual stocks, with some gaining ground and others losing value.

Case Study: Tesla

One notable case study was Tesla, which reported a strong second-quarter earnings report. The company's shares surged by 5% following the announcement, reflecting investor optimism about its future growth prospects. This highlighted the importance of earnings reports in shaping investor sentiment.

Conclusion

The US stock market on July 27, 2025, demonstrated the unpredictable nature of the financial world. While the Federal Reserve's interest rate decision caused some concern, the market quickly adjusted to the new reality. The day's trading reflected the importance of staying informed and adapting to changing market conditions. As always, investors should exercise caution and seek professional advice when making investment decisions.

dow and nasdaq today